HOW TO AVOID NOTICE OF DEFICIENCY

Few experiences are as anxiety producing as going to the mailbox and finding a letter from the IRS. Typically the initial letter you’ll receive is a Notice of Deficiency, also known as an IRS 90-day letter, is an official written claim by the Internal Revenue Service that has found you owe income taxes, and often interest and penalties. This notice informs you that an assessment is being made on the income tax you owe and designed to give a taxpayer the chance to pay what is owed to the IRS.

Why Did I Receive an IRS Notice of Deficiency?

An IRS Notice of Deficiency is issued when the IRS is proposing a change to a tax return because they found that the information reported on the return does not match their records. Known as IRS Notice CP3219, this informs you that a third party filer, like your employer or another financial institution you have accounts with, has sent in information that doesn’t coincide with what you recorded. Where we see this most frequently is with taxpayers who earn W2 income for more than one job, or who do contract work for several employers who issue a 1099 for the contract work earnings.

If the taxpayer doesn’t report one or more of the W2s or 1099s on his return this will trigger a review of unreported income. The IRS will then compare the tax return to their records as submitted by the employers and will find that the taxpayer did not report one or more sources of income. The IRS then adds that unreported W2 to the taxpayer’s return, which will likely change the tax. You also may receive a statutory notice of deficiency if the IRS sent you one or more pre-assessment letters requesting income, credit, or deduction verification, but never received a response from you. If it does change the tax, whether it lowers it or increases it, the IRS will issue a Statutory Notice of Deficiency to inform the taxpayer of the proposed change to the return. The notice will explain the proposed increase or decrease in tax, how that change was calculated and how that proposed amount can be challenged or agreed to.

If the taxpayer doesn’t report one or more of the W2s or 1099s on his return this will trigger a review of unreported income. The IRS will then compare the tax return to their records as submitted by the employers and will find that the taxpayer did not report one or more sources of income. The IRS then adds that unreported W2 to the taxpayer’s return, which will likely change the tax. You also may receive a statutory notice of deficiency if the IRS sent you one or more pre-assessment letters requesting income, credit, or deduction verification, but never received a response from you. If it does change the tax, whether it lowers it or increases it, the IRS will issue a Statutory Notice of Deficiency to inform the taxpayer of the proposed change to the return. The notice will explain the proposed increase or decrease in tax, how that change was calculated and how that proposed amount can be challenged or agreed to.

How Soon Will I Receive a Notice of Deficiency IRS After Filing?

The Internal Revenue Service uses computer systems to match the information you have provided on your tax return with the information reported by third parties such as banks, employers, businesses, and other accounts. This matching can take a few months to complete, so you may receive this notice three or four months after filing your tax return. An official IRS Notice of Deficiency arrives only after a first notice and Examination Report have both been sent and ignored.

Is an IRS Notice of Deficiency a Tax Bill?

It is not. The notice reflects the information the Internal Revenue Service received and explains how it will affect your tax, and gives you contact information should you choose to file a petition with the tax court. If you’ve received an IRS Notice of Deficiency,

contact us today and let our team help you come up with a plan.

contact us today and let our team help you come up with a plan.

What Should I Do if I Agree with the Notice of Deficiency?

If you or your spouse work multiple jobs it can be easy to overlook a source of income. Many times we see that 1099s are not issued in a timely manner by the employer and the taxpayer was anxious to get their return submitted early, and did so before receiving all income reports.

If you agree with the amendment the Internal Revenue Service has made and you don’t have any additional income, expenses, or credits that you should report, you won’t need to amend your tax return. Simply sign Form 5564, Notice of Deficiency – Waver and send it back to the government agency. If you agree but have additional income, expenses, or credits to claim, you’ll need to amend your original tax return with Form 1040-X.

If you realize the IRS is correct, pay off what you owe as quickly as possible, as it will start accruing interest. If you can’t afford to pay it all immediately, you have the option to call the IRS notice of deficiency contact number you’ll find on the letter received and work out a payment plan to avoid further penalties.

Frequently you will be refused this accommodation when you first contact the service. This is particularly the case if the amount owed is more than $2500. If this happens, you’ll want to contact us right away. We can help you create a payment plan that our attorneys will present to the IRS on your behalf.

If you agree with the amendment the Internal Revenue Service has made and you don’t have any additional income, expenses, or credits that you should report, you won’t need to amend your tax return. Simply sign Form 5564, Notice of Deficiency – Waver and send it back to the government agency. If you agree but have additional income, expenses, or credits to claim, you’ll need to amend your original tax return with Form 1040-X.

If you realize the IRS is correct, pay off what you owe as quickly as possible, as it will start accruing interest. If you can’t afford to pay it all immediately, you have the option to call the IRS notice of deficiency contact number you’ll find on the letter received and work out a payment plan to avoid further penalties.

Frequently you will be refused this accommodation when you first contact the service. This is particularly the case if the amount owed is more than $2500. If this happens, you’ll want to contact us right away. We can help you create a payment plan that our attorneys will present to the IRS on your behalf.

SPEAK WITH ONE OF OUR TAX PROFESSIONALS TODAY

FREE CONSULTATION

{"name":"Contact Button","action_type":"1","optin_action_type":"5","form_redirect_type":"1","form_redirect_funnel_url":"5ecea1dde7bd0","form_redirect_custom_url":"","order_form_settings":{"containers":[{"id":"personal-info-wrapper","visible":true,"label":{"id":"of-personal-title","visible":true},"fields":[{"id":"of-full-name","setting":false,"placeholder":"Full Name"},{"id":"of-field-email","setting":false,"placeholder":"Email Address"},{"id":"of-phone-number","setting":true,"visible":false,"require":true,"placeholder":"Enter Your Mobile Phone","additional":{"sms_permission":0}},{"id":"of-gdpr-optin-approval","label":"I Accept To Receive Additional Info","placeholder":"","icon":"fa-mobile","required":0,"visible":0,"system":1,"additional":{"gdpr_optin_approval":"1"}}]},{"id":"shipping-information-wrapper","visible":false,"label":{"id":"of-shipping-title","visible":true},"fields":[{"id":"of-shipping-address","setting":false,"placeholder":"Address"},{"id":"of-shipping-city","setting":false,"placeholder":"City"},{"id":"of-shipping-state","setting":false,"placeholder":"State"},{"id":"of-shipping-zipcode","setting":false,"placeholder":"Postal Code"}]},{"id":"credit-card-wrapper","visible":true,"label":{"id":"of-ccard-title","visible":true},"fields":[{"id":"of-ccard-number","setting":false,"placeholder":"Credit Card Number"},{"id":"of-ccard-cvc","setting":false,"placeholder":"CVC"}]},{"id":"profit-bump-wrapper","visible":true,"otoBgColor":"rgba(219,229,239,1)","otoBorderColor":"rgba(38,71,102,1)","otoTitleBgColor":"rgba(45,78,108,1)","otoArrowsColor":"rgba(255,177,58,1)","fields":[]},{"id":"order-summary-wrapper","visible":true,"orderDynamicBgColor":"rgba(242,242,242,1)","orderDynamicTexColor":"rgba(51,51,51,1)","fields":[]}]},"optin_type":{"showLabels":0,"fields":[{"name":"first_name","label":"Full Name","placeholder":"Enter Your Full Name","icon":"fa-user","required":1,"visible":1,"system":1,"additional":{}},{"name":"last_name","label":"Full Name","placeholder":"Enter Your Full Name","icon":"fa-user","required":1,"visible":1,"system":1,"additional":{}},{"name":"email","label":"Email","placeholder":"Enter Your Email","icon":"fa-envelope","required":1,"visible":1,"system":1,"additional":{}},{"name":"mobile_phone","label":"Mobile Phone","placeholder":"Enter Your Mobile Phone","icon":"fa-mobile","required":0,"visible":0,"system":1,"additional":{"sms_permission":0}},{"name":"fields_labels","label":"","placeholder":"","icon":"","required":0,"visible":1,"system":1,"additional":{}},{"name":"captcha","label":"Captcha","placeholder":"","icon":"","required":0,"visible":0,"system":1,"additional":{}},{"name":"gdpr_optin_approval","label":"SSBBY2NlcHQgVG8gUmVjZWl2ZSBBZGRpdGlvbmFsIEluZm8=","placeholder":"","icon":"fa-mobile","required":0,"visible":1,"system":1,"additional":{"gdpr_optin_approval":"1","sms_permission":0}}],"customFields":[],"sortedFields":[{"name":"first_name","label":"Full Name","placeholder":"Enter Your Full Name","icon":"fa-user","required":1,"visible":1,"system":1,"additional":{}},{"name":"first_name","label":"Full Name","placeholder":"Enter Your Full Name","icon":"fa-user","required":1,"visible":1,"system":1,"additional":{}},{"name":"last_name","label":"Full Name","placeholder":"Enter Your Full Name","icon":"fa-user","required":1,"visible":1,"system":1,"additional":{}},{"name":"email","label":"Email","placeholder":"Enter Your Email","icon":"fa-envelope","required":1,"visible":1,"system":1,"additional":{}},{"name":"mobile_phone","label":"Mobile Phone","placeholder":"Enter Your Mobile Phone","icon":"fa-mobile","required":0,"visible":0,"system":1,"additional":{"sms_permission":0}},{"name":"captcha","label":"Captcha","placeholder":"","icon":"","required":0,"visible":0,"system":1,"additional":{}}],"design":{"form_background_color":"rgb(245, 245, 245)","field_stroke":{"size":"1","color":"rgb(220, 220, 220)"},"field_icons":1,"button_color":"rgb(255, 158, 0)","button_stroke":{"size":"0","color":"rgba(255, 255, 255, 0.2)"},"button_box_shadow_color":"rgb(213, 139, 18) 0px 2px 0px 0px","field_size":"small","label_size":"16","label_color":"rgb(3, 3, 3)","input_color":"rgb(52, 152, 219)","control_text_color":"rgb(3, 3, 3)","control_text_size":"15"},"mappedFields":[]},"redirect_type":{"url":"http://ustaxreliefagency.com/contact","target":1},"next_step":{"value":"5ecea1dde7bd0"},"click_to_email":{"value":""},"click_to_call":{"value":""},"jump_to_block":{},"content":{"header_text":"PHNwYW4gc3R5bGU9ImZvbnQtc2l6ZToyNHB4OyBmb250LWZhbWlseTonb3BlbiBzYW5zJzsiPjxzcGFuIHN0eWxlPSJsaW5lLWhlaWdodDoxLjRlbTsiPldlIEFyZSBFeGNpdGVkITwvc3Bhbj48L3NwYW4+","content_text":"PHNwYW4gc3R5bGU9ImZvbnQtc2l6ZTo0OHB4OyBmb250LWZhbWlseTonb3BlbiBzYW5zJzsiPjxzcGFuIHN0eWxlPSJsaW5lLWhlaWdodDowLjllbTsiPjxzdHJvbmc+UExFQVNFIEZJTEwgT1VUIFlPVVIgSU5GTyAgQkVMT1cgVE8gU1VCU0NSSUJFPC9zdHJvbmc+PC9zcGFuPjwvc3Bhbj4=","button_text":"dW5kZWZpbmVk","spam_text":"PHNwYW4gc3R5bGU9ImxpbmUtaGVpZ2h0OjEuMmVtOyI+V2UgaGF0ZSBTUEFNIGFuZCBwcm9taXNlIHRvIGtlZXAgeW91ciBlbWFpbCBhZGRyZXNzIHNhZmU8L3NwYW4+","sms_text":"UmVjZWl2ZSBTTVMgVGV4dCBVcGRhdGVzIC0gPHNwYW4+b3B0aW9uYWw8L3NwYW4+","sms_text2":"SSBBY2NlcHQgVG8gUmVjZWl2ZSBBZGRpdGlvbmFsIEluZm8="},"email_confirmation":{"enable":1,"subject":"V2UgQXJlIEV4Y2l0ZWQhIFlvdXIgSW4h","message":""},"integrations":{"name":"Form Optin Conversion","tag_id":""},"automation_enable":0,"thank_you":{"type":"popup","redirect_url":"","popup_options":{"background_color":"#ffffff","headline_visible":1,"icon_visible":1,"icon_url":"//my.funnelpages.com/assets-pb/images/thankyou-popup-icon.png","subheadline_visible":1,"button_visible":1,"button_color":"#ffa800","headline_text":"PHNwYW4gc3R5bGU9ImxpbmUtaGVpZ2h0OjEuNGVtOyI+VGhhbmsgWW91IEZvciBDb250YWN0aW5nIFVzPC9zcGFuPg==","subeadline_text":"PHNwYW4gc3R5bGU9ImxpbmUtaGVpZ2h0OjEuNGVtOyI+UGxlYXNlIENoZWNrIFlvdXIgRW1haWw8YnIgLz5XZSBXaWxsIEJlIEZvbGxvd2luZyBVcCBTaG9ydGx5PC9zcGFuPg==","button_text":"Q2xvc2U="}}}

What If I Disagree with Statutory Notice of Deficiency?

If you think the IRS has received incorrect information or is mistaken, you can contact them with additional information and plead your case. You have 90 days from the date of the notice to dispute the claim by petitioning the Tax Court to reassess the liability proposed by your account’s examining agent. During this time, the IRS cannot assess or perform collections on your accounts.

The first step is to provide the IRS with a written statement that explains the reason for your appeal. It’s wise to consider using the help of a tax attorney before appealing; their counsel can advise you on the validity of your claim and save you time and money in the long run. If you’re incorrect, a tax expert will likely notice it before you appeal; if you’re correct, they can help you better prepare an appeal.

If your appeal proves to be unsuccessful, you’ll be required to pay the disputed amount and file a claim for a refund with the IRS. If they deny your claim, you may choose to file a lawsuit with the United States Court of Federal Claims or federal district court. You can also file a petition with the United States Tax Court to resolve the matter.

Always employ the help of an experienced tax attorney to help plead your case in either of these situations. Our team has resolved numerous cases, helping our clients craft airtight appeals. Contact us now for professional tax assistance.

The first step is to provide the IRS with a written statement that explains the reason for your appeal. It’s wise to consider using the help of a tax attorney before appealing; their counsel can advise you on the validity of your claim and save you time and money in the long run. If you’re incorrect, a tax expert will likely notice it before you appeal; if you’re correct, they can help you better prepare an appeal.

If your appeal proves to be unsuccessful, you’ll be required to pay the disputed amount and file a claim for a refund with the IRS. If they deny your claim, you may choose to file a lawsuit with the United States Court of Federal Claims or federal district court. You can also file a petition with the United States Tax Court to resolve the matter.

Always employ the help of an experienced tax attorney to help plead your case in either of these situations. Our team has resolved numerous cases, helping our clients craft airtight appeals. Contact us now for professional tax assistance.

Can I Get An Extension On My Response Time?

No, unfortunately once the Notice of Deficiency has been issued, the IRS will not extend the time you have to respond or to file a petition with the U.S. Tax Court. Once you receive a Notice of Deficiency, you have 90 days to dispute the assessment; this 90-day period begins the day the statutory notice of deficiency is mailed to the taxpayer. That’s why it’s essential you get the IRS Notice of Deficiency help you need as soon as possible.

What Happens if I Ignore My Notice of Deficiency?

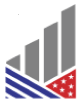

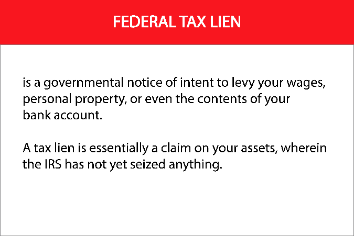

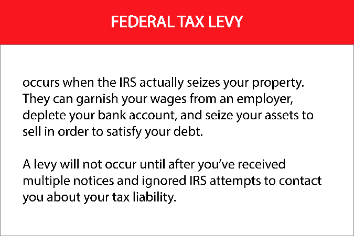

In two words: Nothing Good! If you ignore your Statutory Deficiency and let your tax debt go unpaid, you can face several consequences:

How Can I Avoid a Notice of Deficiency Next Year?

It’s important to take proper steps to ensure you never find yourself in this situation again. Adhering to the following practices can help you avoid a future Notice of Deficiency:

- Keep accurate and full records all year long.

- Hold off on filing your tax return until you’ve received all of your income statements.

- Check your records with your employer, bank, mortgage broker, or other income sources to ensure they’ve been listed correctly.

- Be sure that all of your income is included on your tax return.

- Strictly follow instructions on reporting income, deductions, and expenses.

- File an amended tax return if you receive more information after you’ve filed your return to reassess your tax liability.

Attempting to file on your own can leave you vulnerable. If you’ve been notified of a tax deficiency, it’s important to determine steps that can circumvent the re-occurrence of a tax audit.

US Tax Relief may recommend filing an amended return or to pursue audit defense to prove the unreported item is not taxable.

The US Tax Relief audit representative will be able to catch such discrepancies that go unnoticed by the IRS and will recommend a course of action to prevent those fraudulent items from changing the taxpayer’s tax return.

There is significant value in contacting us if you need IRS Notice of Deficiency help. Although the Notice of Deficiency will explain why the changes are made, the IRS will not specify what can be done to challenge the proposal. We can evaluate all options and recommend the course of action most likely to be successful. If the taxpayer chooses to challenge the tax liability assessment, US Tax Relief will handle that challenge by compiling all required documents, drafting all necessary forms and representing the taxpayer in front of the IRS.

The US Tax Relief audit representative will be able to catch such discrepancies that go unnoticed by the IRS and will recommend a course of action to prevent those fraudulent items from changing the taxpayer’s tax return.

There is significant value in contacting us if you need IRS Notice of Deficiency help. Although the Notice of Deficiency will explain why the changes are made, the IRS will not specify what can be done to challenge the proposal. We can evaluate all options and recommend the course of action most likely to be successful. If the taxpayer chooses to challenge the tax liability assessment, US Tax Relief will handle that challenge by compiling all required documents, drafting all necessary forms and representing the taxpayer in front of the IRS.

Here’s The Bottom Line:

A Notice of Deficiency is a serious matter and should not be ignored. It Will Not Just “Go Away.”

Contact us immediately if you receive a notice. Let us analyze your situation and present options for your consideration.

Contact us immediately if you receive a notice. Let us analyze your situation and present options for your consideration.

SPEAK WITH ONE OF OUR TAX PROFESSIONALS TODAY

FREE CONSULTATION

{"name":"Contact Button 1","action_type":"1","optin_action_type":"5","form_redirect_type":"1","form_redirect_funnel_url":"5ecea1dde7bd0","form_redirect_custom_url":"","order_form_settings":{"containers":[{"id":"personal-info-wrapper","visible":true,"label":{"id":"of-personal-title","visible":true},"fields":[{"id":"of-full-name","setting":false,"placeholder":"Full Name"},{"id":"of-field-email","setting":false,"placeholder":"Email Address"},{"id":"of-phone-number","setting":true,"visible":false,"require":true,"placeholder":"Enter Your Mobile Phone","additional":{"sms_permission":0}},{"id":"of-gdpr-optin-approval","label":"I Accept To Receive Additional Info","placeholder":"","icon":"fa-mobile","required":0,"visible":0,"system":1,"additional":{"gdpr_optin_approval":"1"}}]},{"id":"shipping-information-wrapper","visible":false,"label":{"id":"of-shipping-title","visible":true},"fields":[{"id":"of-shipping-address","setting":false,"placeholder":"Address"},{"id":"of-shipping-city","setting":false,"placeholder":"City"},{"id":"of-shipping-state","setting":false,"placeholder":"State"},{"id":"of-shipping-zipcode","setting":false,"placeholder":"Postal Code"}]},{"id":"credit-card-wrapper","visible":true,"label":{"id":"of-ccard-title","visible":true},"fields":[{"id":"of-ccard-number","setting":false,"placeholder":"Credit Card Number"},{"id":"of-ccard-cvc","setting":false,"placeholder":"CVC"}]},{"id":"profit-bump-wrapper","visible":true,"otoBgColor":"rgba(219,229,239,1)","otoBorderColor":"rgba(38,71,102,1)","otoTitleBgColor":"rgba(45,78,108,1)","otoArrowsColor":"rgba(255,177,58,1)","fields":[]},{"id":"order-summary-wrapper","visible":true,"orderDynamicBgColor":"rgba(242,242,242,1)","orderDynamicTexColor":"rgba(51,51,51,1)","fields":[]}]},"optin_type":{"showLabels":0,"fields":[{"name":"first_name","label":"Full Name","placeholder":"Enter Your Full Name","icon":"fa-user","required":1,"visible":1,"system":1,"additional":{}},{"name":"last_name","label":"Full Name","placeholder":"Enter Your Full Name","icon":"fa-user","required":1,"visible":1,"system":1,"additional":{}},{"name":"email","label":"Email","placeholder":"Enter Your Email","icon":"fa-envelope","required":1,"visible":1,"system":1,"additional":{}},{"name":"mobile_phone","label":"Mobile Phone","placeholder":"Enter Your Mobile Phone","icon":"fa-mobile","required":0,"visible":0,"system":1,"additional":{"sms_permission":0}},{"name":"fields_labels","label":"","placeholder":"","icon":"","required":0,"visible":1,"system":1,"additional":{}},{"name":"captcha","label":"Captcha","placeholder":"","icon":"","required":0,"visible":0,"system":1,"additional":{}},{"name":"gdpr_optin_approval","label":"SSBBY2NlcHQgVG8gUmVjZWl2ZSBBZGRpdGlvbmFsIEluZm8=","placeholder":"","icon":"fa-mobile","required":0,"visible":1,"system":1,"additional":{"gdpr_optin_approval":"1","sms_permission":0}}],"customFields":[],"sortedFields":[{"name":"first_name","label":"Full Name","placeholder":"Enter Your Full Name","icon":"fa-user","required":1,"visible":1,"system":1,"additional":{}},{"name":"first_name","label":"Full Name","placeholder":"Enter Your Full Name","icon":"fa-user","required":1,"visible":1,"system":1,"additional":{}},{"name":"last_name","label":"Full Name","placeholder":"Enter Your Full Name","icon":"fa-user","required":1,"visible":1,"system":1,"additional":{}},{"name":"email","label":"Email","placeholder":"Enter Your Email","icon":"fa-envelope","required":1,"visible":1,"system":1,"additional":{}},{"name":"mobile_phone","label":"Mobile Phone","placeholder":"Enter Your Mobile Phone","icon":"fa-mobile","required":0,"visible":0,"system":1,"additional":{"sms_permission":0}},{"name":"captcha","label":"Captcha","placeholder":"","icon":"","required":0,"visible":0,"system":1,"additional":{}}],"design":{"form_background_color":"rgb(245, 245, 245)","field_stroke":{"size":"1","color":"rgb(220, 220, 220)"},"field_icons":1,"button_color":"rgb(255, 158, 0)","button_stroke":{"size":"0","color":"rgba(255, 255, 255, 0.2)"},"button_box_shadow_color":"rgb(213, 139, 18) 0px 2px 0px 0px","field_size":"small","label_size":"16","label_color":"rgb(3, 3, 3)","input_color":"rgb(52, 152, 219)","control_text_color":"rgb(3, 3, 3)","control_text_size":"15"},"mappedFields":[]},"redirect_type":{"url":"https://112785.funnelpages.com/contact-us","target":1},"next_step":{"value":"5ecea1dde7bd0"},"click_to_email":{"value":""},"click_to_call":{"value":""},"jump_to_block":{},"content":{"header_text":"PHNwYW4gc3R5bGU9ImZvbnQtc2l6ZToyNHB4OyBmb250LWZhbWlseTonb3BlbiBzYW5zJzsiPjxzcGFuIHN0eWxlPSJsaW5lLWhlaWdodDoxLjRlbTsiPldlIEFyZSBFeGNpdGVkITwvc3Bhbj48L3NwYW4+","content_text":"PHNwYW4gc3R5bGU9ImZvbnQtc2l6ZTo0OHB4OyBmb250LWZhbWlseTonb3BlbiBzYW5zJzsiPjxzcGFuIHN0eWxlPSJsaW5lLWhlaWdodDowLjllbTsiPjxzdHJvbmc+UExFQVNFIEZJTEwgT1VUIFlPVVIgSU5GTyAgQkVMT1cgVE8gU1VCU0NSSUJFPC9zdHJvbmc+PC9zcGFuPjwvc3Bhbj4=","button_text":"dW5kZWZpbmVk","spam_text":"PHNwYW4gc3R5bGU9ImxpbmUtaGVpZ2h0OjEuMmVtOyI+V2UgaGF0ZSBTUEFNIGFuZCBwcm9taXNlIHRvIGtlZXAgeW91ciBlbWFpbCBhZGRyZXNzIHNhZmU8L3NwYW4+","sms_text":"UmVjZWl2ZSBTTVMgVGV4dCBVcGRhdGVzIC0gPHNwYW4+b3B0aW9uYWw8L3NwYW4+","sms_text2":"SSBBY2NlcHQgVG8gUmVjZWl2ZSBBZGRpdGlvbmFsIEluZm8="},"email_confirmation":{"enable":1,"subject":"V2UgQXJlIEV4Y2l0ZWQhIFlvdXIgSW4h","message":""},"integrations":{"name":"Form Optin Conversion","tag_id":""},"automation_enable":0,"thank_you":{"type":"popup","redirect_url":"","popup_options":{"background_color":"#ffffff","headline_visible":1,"icon_visible":1,"icon_url":"//my.funnelpages.com/assets-pb/images/thankyou-popup-icon.png","subheadline_visible":1,"button_visible":1,"button_color":"#ffa800","headline_text":"PHNwYW4gc3R5bGU9ImxpbmUtaGVpZ2h0OjEuNGVtOyI+VGhhbmsgWW91IEZvciBDb250YWN0aW5nIFVzPC9zcGFuPg==","subeadline_text":"PHNwYW4gc3R5bGU9ImxpbmUtaGVpZ2h0OjEuNGVtOyI+UGxlYXNlIENoZWNrIFlvdXIgRW1haWw8YnIgLz5XZSBXaWxsIEJlIEZvbGxvd2luZyBVcCBTaG9ydGx5PC9zcGFuPg==","button_text":"Q2xvc2U="}}}

© 2021 US Tax Relief Agency All Rights Reserved. 732-E Eden Way North, Suite 250, , Chesapeake, VA 23320 . Contact Us . Terms of Service . Privacy Policy

eyJjb21wYW55IjoiVVMgVGF4IFJlbGllZiBBZ2VuY3kiLCJhZGRyZXNzIjoiNzMyLUUgRWRlbiBXYXkgTm9ydGgsIFN1aXRlIDI1MCwgIiwiY2l0eSI6IkNoZXNhcGVha2UiLCJzdGF0ZSI6IlZBICIsInppcCI6IjIzMzIwIiwiZW1haWwiOiJnb3Jkb25AdXN0YXhyZWxpZWZhZ2VuY3kuY29tIiwidG9zIjoiUEhBZ2MzUjViR1U5SW5SbGVIUXRZV3hwWjI0NklHTmxiblJsY2pzaVBqeHpkSEp2Ym1jK1ZWTWdWR0Y0SUZKbGJHbGxaaUJCWjJWdVkza2dWRVZTVFZNZ1FVNUVJRU5QVGtSSlZFbFBUbE04WW5JZ0x6NEtUR0Z6ZENCVmNHUmhkR1ZrT2lCaGRXZDFjM1FnTVRVc0lESXdNVGc4TDNOMGNtOXVaejQ4TDNBK0NnbzhjRDQ4WW5JZ0x6NEtQSE4wY205dVp6NUpUbFJTVDBSVlExUkpUMDQ4TDNOMGNtOXVaejQ4WW5JZ0x6NEtQR0p5SUM4K0NsUm9aU0JVWlhKdGN5QmhibVFnUTI5dVpHbDBhVzl1Y3lBb0pteGtjWFZ2T3p4emRISnZibWMrVkdWeWJYTThMM04wY205dVp6NG1jbVJ4ZFc4N0tTQmtaWE5qY21saVpTQm9iM2NnVlZNZ1ZHRjRJRkpsYkdsbFppQkJaMlZ1WTNrc0lETTRNekFnVnk0Z056TnlaQ0JCZG1WdWRXVWdJekl3TWl3Z1YyVnpkRzFwYm5OMFpYSXNJRU5QSURnd01ETXdJQ2dtYkdSeGRXODdQSE4wY205dVp6NURiMjF3WVc1NVBDOXpkSEp2Ym1jK0xDWnlaSEYxYnpzZ0pteGtjWFZ2T3p4emRISnZibWMrZDJVOEwzTjBjbTl1Wno0c0puSmtjWFZ2T3lCaGJtUWdKbXhrY1hWdk96eHpkSEp2Ym1jK2IzVnlQQzl6ZEhKdmJtYytKbkprY1hWdk95a2djbVZuZFd4aGRHVnpJSGx2ZFhJZ2RYTmxJRzltSUhSb2FYTWdkMlZpYzJsMFpTQjNkM2N1ZEdobFlXeGphR1Z0ZVdOdmJuTjFiSFJwYm1kbmNtOTFjQzVqYjIwZ0tIUm9aU0FtYkdSeGRXODdQSE4wY205dVp6NVRhWFJsUEM5emRISnZibWMrSm5Ka2NYVnZPeWt1SUZCc1pXRnpaU0J5WldGa0lIUm9aU0JtYjJ4c2IzZHBibWNnYVc1bWIzSnRZWFJwYjI0Z1kyRnlaV1oxYkd4NUlIUnZJSFZ1WkdWeWMzUmhibVFnYjNWeUlIQnlZV04wYVdObGN5QnlaV2RoY21ScGJtY2dlVzkxY2lCMWMyVWdiMllnZEdobElGTnBkR1V1SUZSb1pTQkRiMjF3WVc1NUlHMWhlU0JqYUdGdVoyVWdkR2hsSUZSbGNtMXpJR0YwSUdGdWVTQjBhVzFsTGlCVWFHVWdRMjl0Y0dGdWVTQnRZWGtnYVc1bWIzSnRJSGx2ZFNCdlppQjBhR1VnWTJoaGJtZGxjeUIwYnlCMGFHVWdWR1Z5YlhNZ2RYTnBibWNnZEdobElHRjJZV2xzWVdKc1pTQnRaV0Z1Y3lCdlppQmpiMjF0ZFc1cFkyRjBhVzl1TGlCVWFHVWdRMjl0Y0dGdWVTQnlaV052YlcxbGJtUnpJSGx2ZFNCMGJ5QmphR1ZqYXlCMGFHVWdVMmwwWlNCbWNtVnhkV1Z1ZEd4NUlIUnZJSE5sWlNCMGFHVWdZV04wZFdGc0lIWmxjbk5wYjI0Z2IyWWdkR2hsSUZSbGNtMXpJR0Z1WkNCMGFHVnBjaUJ3Y21WMmFXOTFjeUIyWlhKemFXOXVjeTQ4WW5JZ0x6NEtQR0p5SUM4K0NrbG1JSGx2ZFNCeVpYQnlaWE5sYm5RZ1lTQnNaV2RoYkNCbGJuUnBkSGtzSUhsdmRTQmpaWEowYVdaNUlIUm9ZWFFnZVc5MUlHVnVkR2wwYkdWa0lHSjVJSE4xWTJnZ1lTQnNaV2RoYkNCbGJuUnBkSGtnZEc4Z1kyOXVZMngxWkdVZ2RHaGxJRlJsY20xeklHRnpJSFJvWlNCc1pXZGhiQ0JsYm5ScGRIa2dlVzkxSUhKbGNISmxjMlZ1ZEM0OFluSWdMejRLUEdKeUlDOCtDanh6ZEhKdmJtYytNUzRnVUZKSlZrRkRXU0JRVDB4SlExazhMM04wY205dVp6NDhZbklnTHo0S1BHSnlJQzgrQ2s5MWNpQlFjbWwyWVdONUlGQnZiR2xqZVNCcGN5QmhkbUZwYkdGaWJHVWdiMjRnWVNCelpYQmhjbUYwWlNCd1lXZGxMaUJQZFhJZ1VISnBkbUZqZVNCUWIyeHBZM2tnWlhod2JHRnBibk1nZEc4Z2VXOTFJR2h2ZHlCM1pTQndjbTlqWlhOeklHbHVabTl5YldGMGFXOXVJR0ZpYjNWMElIbHZkUzRnV1c5MUlITm9ZV3hzSUhWdVpHVnljM1JoYm1RZ2RHaGhkQ0IwYUhKdmRXZG9JSGx2ZFhJZ2RYTmxJRzltSUhSb1pTQlRhWFJsSUhsdmRTQmhZMnR1YjNkc1pXUm5aU0IwYUdVZ2NISnZZMlZ6YzJsdVp5QnZaaUIwYUdseklHbHVabTl5YldGMGFXOXVJSE5vWVd4c0lHSmxJSFZ1WkdWeWRHRnJaVzRnYVc0Z1lXTmpiM0prWVc1alpTQjNhWFJvSUhSb1pTQlFjbWwyWVdONUlGQnZiR2xqZVM0OFluSWdMejRLUEdKeUlDOCtDanh6ZEhKdmJtYytNaTRnV1U5VlVpQkJRME5QVlU1VVBDOXpkSEp2Ym1jK1BHSnlJQzgrQ2p4aWNpQXZQZ3BYYUdWdUlIVnphVzVuSUhSb1pTQlRhWFJsTENCNWIzVWdjMmhoYkd3Z1ltVWdjbVZ6Y0c5dWMybGliR1VnWm05eUlHVnVjM1Z5YVc1bklIUm9aU0JqYjI1bWFXUmxiblJwWVd4cGRIa2diMllnZVc5MWNpQmhZMk52ZFc1MExDQndZWE56ZDI5eVpDQmhibVFnYjNSb1pYSWdZM0psWkdWdWRHbGhiSE1nWVc1a0lHWnZjaUJ6WldOMWNtVWdZV05qWlhOeklIUnZJSGx2ZFhJZ1pHVjJhV05sTGlCWmIzVWdjMmhoYkd3Z2JtOTBJR0Z6YzJsbmJpQjViM1Z5SUdGalkyOTFiblFnZEc4Z1lXNTViMjVsTGlCVWFHVWdRMjl0Y0dGdWVTQnBjeUJ1YjNRZ2NtVnpjRzl1YzJsaWJHVWdabTl5SUhWdVlYVjBhRzl5YVhwbFpDQmhZMk5sYzNNZ2RHOGdlVzkxY2lCaFkyTnZkVzUwSUhSb1lYUWdjbVZ6ZFd4MGN5Qm1jbTl0SUcxcGMyRndjSEp2Y0hKcFlYUnBiMjRnYjNJZ2RHaGxablFnYjJZZ2VXOTFjaUJoWTJOdmRXNTBMaUJVYUdVZ1EyOXRjR0Z1ZVNCdFlYa2djbVZtZFhObElHOXlJR05oYm1ObGJDQnpaWEoyYVdObExDQjBaWEp0YVc1aGRHVWdlVzkxY2lCaFkyTnZkVzUwTENCaGJtUWdjbVZ0YjNabElHOXlJR1ZrYVhRZ1kyOXVkR1Z1ZEM0OFluSWdMejRLUEdKeUlDOCtDbFJvWlNCRGIyMXdZVzU1SUdSdlpYTWdibTkwSUd0dWIzZHBibWRzZVNCamIyeHNaV04wSUhCbGNuTnZibUZzSUdSaGRHRWdabkp2YlNCd1pYSnpiMjV6SUhWdVpHVnlJSFJvWlNCaFoyVWdiMllnTVRZZ0tITnBlSFJsWlc0cExpQkpaaUI1YjNVZ1lYSmxJSFZ1WkdWeUlERTJJQ2h6YVhoMFpXVnVLU0I1WldGeWN5QnZiR1FzSUhsdmRTQnRZWGtnYm05MElIVnpaU0IwYUdVZ1UybDBaU0JoYm1RZ2JXRjVJRzV2ZENCbGJuUmxjaUJwYm5SdklIUm9aU0JVWlhKdGN5QjFibVJsY2lCaGJua2dZMmx5WTNWdGMzUmhibU5sY3k0OFluSWdMejRLUEdKeUlDOCtDanh6ZEhKdmJtYytNeTRnVTBWU1ZrbERSVk04TDNOMGNtOXVaejQ4WW5JZ0x6NEtQR0p5SUM4K0NsUm9aU0JUYVhSbElHRnNiRzkzY3lCNWIzVWdkRzhnZFhObElGTmxjblpwWTJWeklHRjJZV2xzWVdKc1pTQnZiaUIwYUdVZ1UybDBaUzRnV1c5MUlITm9ZV3hzSUc1dmRDQjFjMlVnZEdobElITmxjblpwWTJWeklHWnZjaUIwYUdVZ2FXeHNaV2RoYkNCaGFXMXpManhpY2lBdlBncFhaU0J0WVhrc0lHRjBJRzkxY2lCemIyeGxJR1JwYzJOeVpYUnBiMjRzSUhObGRDQm1aV1Z6SUdadmNpQjFjMmx1WnlCMGFHVWdVMmwwWlNCbWIzSWdlVzkxTGlCQmJHd2djSEpwWTJWeklHRnlaU0J3ZFdKc2FYTm9aV1FnYzJWd1lYSmhkR1ZzZVNCdmJpQnlaV3hsZG1GdWRDQndZV2RsY3lCdmJpQjBhR1VnVTJsMFpTNGdWMlVnYldGNUxDQmhkQ0J2ZFhJZ2MyOXNaU0JrYVhOamNtVjBhVzl1TENCaGRDQmhibmtnZEdsdFpTQmphR0Z1WjJVZ1lXNTVJR1psWlhNdVBHSnlJQzgrQ2p4aWNpQXZQZ3BYWlNCdFlYa2dkWE5sSUdObGNuUnBabWxsWkNCd1lYbHRaVzUwSUhONWMzUmxiWE1nZDJocFkyZ2dZV3h6YnlCdFlYa2dhR0YyWlNCMGFHVnBjaUJqYjIxdGFYTnphVzl1Y3k0Z1UzVmphQ0JqYjIxdGFYTnphVzl1Y3lCdFlYa2dZbVVnYVcxd2JHbGxaQ0J2YmlCNWIzVWdkMmhsYmlCNWIzVWdZMmh2YjNObElHRWdjR0Z5ZEdsamRXeGhjaUJ3WVhsdFpXNTBJSE41YzNSbGJTNGdSR1YwWVdsc1pXUWdhVzVtYjNKdFlYUnBiMjRnWVdKdmRYUWdZMjl0YldsemMybHZibk1nYjJZZ2MzVmphQ0J3WVhsdFpXNTBJSE41YzNSbGJYTWdiV0Y1SUdKbElHWnZkVzVrSUc5dUlIUm9aV2x5SUhkbFluTnBkR1Z6TGk0OFluSWdMejRLUEdKeUlDOCtDanh6ZEhKdmJtYytOQzRnVkVoSlVrUWdVRUZTVkZrZ1UwVlNWa2xEUlZNOEwzTjBjbTl1Wno0OFluSWdMejRLUEdKeUlDOCtDbFJvWlNCVGFYUmxJRzFoZVNCcGJtTnNkV1JsSUd4cGJtdHpJSFJ2SUc5MGFHVnlJSE5wZEdWekxDQmhjSEJzYVdOaGRHbHZibk1zSUdGdVpDQndiR0YwWm05eWJYTWdLR2hsY21WcGJtRm1kR1Z5SUhSb1pTQW1jWFZ2ZERzOGMzUnliMjVuUGt4cGJtdGxaQ0JUYVhSbGN6d3ZjM1J5YjI1blBpWnhkVzkwT3lrdVBHSnlJQzgrQ2p4aWNpQXZQZ3BVYUdVZ1EyOXRjR0Z1ZVNCa2IyVnpJRzV2ZENCamIyNTBjbTlzSUhSb1pTQk1hVzVyWldRZ1UybDBaWE1zSUdGdVpDQnphR0ZzYkNCdWIzUWdZbVVnY21WemNHOXVjMmxpYkdVZ1ptOXlJSFJvWlNCamIyNTBaVzUwSUdGdVpDQnZkR2hsY2lCdFlYUmxjbWxoYkhNZ2IyWWdkR2hsSUV4cGJtdGxaQ0JUYVhSbGN5NGdWR2hsSUVOdmJYQmhibmtnYldGclpYTWdkR2hsYzJVZ2JHbHVhM01nWVhaaGFXeGhZbXhsSUhSdklIbHZkU0JtYjNJZ2NISnZkbWxrYVc1bklIUm9aU0JtZFc1amRHbHZibUZzYVhSNUlHOXlJSE5sY25acFkyVnpJRzl1SUhSb1pTQlRhWFJsTGp4aWNpQXZQZ284WW5JZ0x6NEtQSE4wY205dVp6NDFMaUJRVWs5SVNVSkpWRVZFSUZWVFJWTWdRVTVFSUVsT1ZFVk1URVZEVkZWQlRDQlFVazlRUlZKVVdUd3ZjM1J5YjI1blBqeGljaUF2UGdvOFluSWdMejRLVkdobElFTnZiWEJoYm5rZ1ozSmhiblJ6SUhsdmRTQmhJRzV2YmkxMGNtRnVjMlpsY21GaWJHVXNJRzV2YmkxbGVHTnNkWE5wZG1Vc0lISmxkbTlqWVdKc1pTQnNhV05sYm5ObElIUnZJR0ZqWTJWemN5QmhibVFnZFhObElIUm9aU0JUYVhSbElHWnliMjBnYjI1bElHUmxkbWxqWlNCcGJpQmhZMk52Y21SaGJtTmxJSGRwZEdnZ2RHaGxJRlJsY20xekxqeGljaUF2UGdvOFluSWdMejRLV1c5MUlITm9ZV3hzSUc1dmRDQjFjMlVnZEdobElGTnBkR1VnWm05eUlIVnViR0YzWm5Wc0lHOXlJSEJ5YjJocFltbDBaV1FnY0hWeWNHOXpaUzRnV1c5MUlHMWhlU0J1YjNRZ2RYTmxJSFJvWlNCVGFYUmxJR2x1SUdFZ2QyRjVJSFJvWVhRZ2JXRjVJR1JwYzJGaWJHVXNJR1JoYldGblpTd2diM0lnYVc1MFpYSm1aWEpsSUdsdUlIUm9aU0JUYVhSbExqeGljaUF2UGdvOFluSWdMejRLUVd4c0lHTnZiblJsYm5RZ2NISmxjMlZ1ZENCdmJpQjBhR1VnVTJsMFpTQnBibU5zZFdSbGN5QjBaWGgwTENCamIyUmxMQ0JuY21Gd2FHbGpjeXdnYkc5bmIzTXNJR2x0WVdkbGN5d2dZMjl0Y0dsc1lYUnBiMjRzSUhOdlpuUjNZWEpsSUhWelpXUWdiMjRnZEdobElGTnBkR1VnS0dobGNtVnBibUZtZEdWeUlHRnVaQ0JvWlhKbGFXNWlaV1p2Y21VZ2RHaGxJQ1p4ZFc5ME8wTnZiblJsYm5RbWNYVnZkRHNwTGlCVWFHVWdRMjl1ZEdWdWRDQnBjeUIwYUdVZ2NISnZjR1Z5ZEhrZ2IyWWdkR2hsSUVOdmJYQmhibmtnYjNJZ2FYUnpJR052Ym5SeVlXTjBiM0p6SUdGdVpDQndjbTkwWldOMFpXUWdZbmtnYVc1MFpXeHNaV04wZFdGc0lIQnliM0JsY25SNUlHeGhkM01nZEdoaGRDQndjbTkwWldOMElITjFZMmdnY21sbmFIUnpMaUJaYjNVZ1lXZHlaV1VnZEc4Z2RYTmxJR0ZzYkNCamIzQjVjbWxuYUhRZ1lXNWtJRzkwYUdWeUlIQnliM0J5YVdWMFlYSjVJRzV2ZEdsalpYTWdiM0lnY21WemRISnBZM1JwYjI1eklHTnZiblJoYVc1bFpDQnBiaUIwYUdVZ1EyOXVkR1Z1ZENCaGJtUWdlVzkxSUdGeVpTQndjbTlvYVdKcGRHVmtJR1p5YjIwZ1kyaGhibWRwYm1jZ2RHaGxJRU52Ym5SbGJuUXVQR0p5SUM4K0NqeGljaUF2UGdwWmIzVWdiV0Y1SUc1dmRDQndkV0pzYVhOb0xDQjBjbUZ1YzIxcGRDd2diVzlrYVdaNUxDQnlaWFpsY25ObElHVnVaMmx1WldWeUxDQndZWEowYVdOcGNHRjBaU0JwYmlCMGFHVWdkSEpoYm5ObVpYSXNJRzl5SUdOeVpXRjBaU0JoYm1RZ2MyVnNiQ0JrWlhKcGRtRjBhWFpsSUhkdmNtdHpMQ0J2Y2lCcGJpQmhibmtnZDJGNUlIVnpaU0JoYm5rZ2IyWWdkR2hsSUVOdmJuUmxiblF1SUZsdmRYSWdaVzVxYjNsdFpXNTBJRzltSUhSb1pTQlRhWFJsSUhOb1lXeHNJRzV2ZENCbGJuUnBkR3hsSUhsdmRTQjBieUJ0WVd0bElHRnVlU0JwYkd4bFoyRnNJR0Z1WkNCa2FYTmhiR3h2ZDJWa0lIVnpaU0J2WmlCMGFHVWdRMjl1ZEdWdWRDd2dZVzVrSUdsdUlIQmhjblJwWTNWc1lYSWdlVzkxSUhOb1lXeHNJRzV2ZENCamFHRnVaMlVnY0hKdmNISnBaWFJoY25rZ2NtbG5hSFJ6SUc5eUlHNXZkR2xqWlhNZ2FXNGdkR2hsSUVOdmJuUmxiblF1SUZsdmRTQnphR0ZzYkNCMWMyVWdkR2hsSUVOdmJuUmxiblFnYjI1c2VTQm1iM0lnZVc5MWNpQndaWEp6YjI1aGJDQmhibVFnYm05dUxXTnZiVzFsY21OcFlXd2dkWE5sTGlCVWFHVWdRMjl0Y0dGdWVTQmtiMlZ6SUc1dmRDQm5jbUZ1ZENCNWIzVWdZVzU1SUd4cFkyVnVjMlZ6SUhSdklIUm9aU0JwYm5SbGJHeGxZM1IxWVd3Z2NISnZjR1Z5ZEhrZ2IyWWdkR2hsSUVOdmJYQmhibmt1UEdKeUlDOCtDanhpY2lBdlBnbzhjM1J5YjI1blBqWXVJRlJJUlNCRFQwMVFRVTVaSUUxQlZFVlNTVUZNVXp3dmMzUnliMjVuUGp4aWNpQXZQZ284WW5JZ0x6NEtRbmtnY0c5emRHbHVaeXdnZFhCc2IyRmthVzVuTENCcGJuQjFkSFJwYm1jc0lIQnliM1pwWkdsdVp5QnZjaUJ6ZFdKdGFYUjBhVzVuSUhsdmRYSWdRMjl1ZEdWdWRDQjViM1VnWVhKbElHZHlZVzUwYVc1bklIUm9aU0JEYjIxd1lXNTVJSFJ2SUhWelpTQjViM1Z5SUVOdmJuUmxiblFnYVc0Z1kyOXVibVZqZEdsdmJpQjNhWFJvSUhSb1pTQnZjR1Z5WVhScGIyNGdiMllnUTI5dGNHRnVlU1lqTXprN2N5QmlkWE5wYm1WemN5QnBibU5zZFdScGJtY3NJR0oxZENCdWIzUWdiR2x0YVhSbFpDQjBieXdnZEdobElISnBaMmgwY3lCMGJ5QjBjbUZ1YzIxcGRDd2djSFZpYkdsamJIa2daR2x6Y0d4aGVTd2daR2x6ZEhKcFluVjBaU3dnY0hWaWJHbGpiSGtnY0dWeVptOXliU3dnWTI5d2VTd2djbVZ3Y205a2RXTmxMQ0JoYm1RZ2RISmhibk5zWVhSbElIbHZkWElnUTI5dWRHVnVkRHNnWVc1a0lIUnZJSEIxWW14cGMyZ2dlVzkxY2lCdVlXMWxJR2x1SUdOdmJtNWxZM1JwYjI0Z2QybDBhQ0I1YjNWeUlFTnZiblJsYm5RdVBHSnlJQzgrQ2p4aWNpQXZQZ3BPYnlCamIyMXdaVzV6WVhScGIyNGdjMmhoYkd3Z1ltVWdjR0ZwWkNCM2FYUm9JSEpsWjJGeVpDQjBieUIwYUdVZ2RYTmxJRzltSUhsdmRYSWdRMjl1ZEdWdWRDNGdWR2hsSUVOdmJYQmhibmtnYzJoaGJHd2dhR0YyWlNCdWJ5QnZZbXhwWjJGMGFXOXVJSFJ2SUhCMVlteHBjMmdnYjNJZ1pXNXFiM2tnWVc1NUlFTnZiblJsYm5RZ2VXOTFJRzFoZVNCelpXNWtJSFZ6SUdGdVpDQnRZWGtnY21WdGIzWmxJSGx2ZFhJZ1EyOXVkR1Z1ZENCaGRDQmhibmtnZEdsdFpTNDhZbklnTHo0S1BHSnlJQzgrQ2tKNUlIQnZjM1JwYm1jc0lIVndiRzloWkdsdVp5d2dhVzV3ZFhSMGFXNW5MQ0J3Y205MmFXUnBibWNnYjNJZ2MzVmliV2wwZEdsdVp5QjViM1Z5SUVOdmJuUmxiblFnZVc5MUlIZGhjbkpoYm5RZ1lXNWtJSEpsY0hKbGMyVnVkQ0IwYUdGMElIbHZkU0J2ZDI0Z1lXeHNJRzltSUhSb1pTQnlhV2RvZEhNZ2RHOGdlVzkxY2lCRGIyNTBaVzUwTGp4aWNpQXZQZ284WW5JZ0x6NEtQSE4wY205dVp6NDNMaUJFU1ZORFRFRkpUVVZTSUU5R0lFTkZVbFJCU1U0Z1RFbEJRa2xNU1ZSSlJWTThMM04wY205dVp6NDhZbklnTHo0S1BHSnlJQzgrQ2xSb1pTQnBibVp2Y20xaGRHbHZiaUJoZG1GcGJHRmliR1VnZG1saElIUm9aU0JUYVhSbElHMWhlU0JwYm1Oc2RXUmxJSFI1Y0c5bmNtRndhR2xqWVd3Z1pYSnliM0p6SUc5eUlHbHVZV05qZFhKaFkybGxjeTRnVkdobElFTnZiWEJoYm5rZ2MyaGhiR3dnYm05MElHSmxJR3hwWVdKc1pTQm1iM0lnZEdobGMyVWdhVzVoWTJOMWNtRmphV1Z6SUdGdVpDQmxjbkp2Y25NdVBHSnlJQzgrQ2p4aWNpQXZQZ3BVYUdVZ1EyOXRjR0Z1ZVNCdFlXdGxjeUJ1YnlCeVpYQnlaWE5sYm5SaGRHbHZibk1nWVdKdmRYUWdkR2hsSUdGMllXbHNZV0pwYkdsMGVTd2dZV05qZFhKaFkza3NJSEpsYkdsaFltbHNhWFI1TENCemRXbDBZV0pwYkdsMGVTd2dZVzVrSUhScGJXVnNhVzVsYzNNZ2IyWWdkR2hsSUVOdmJuUmxiblFnWTI5dWRHRnBibVZrSUc5dUlHRnVaQ0J6WlhKMmFXTmxjeUJoZG1GcGJHRmliR1VnYjI0Z2RHaGxJRk5wZEdVdUlGUnZJSFJvWlNCdFlYaHBiWFZ0SUdWNGRHVnVkQ0JoYkd4dmQyVmtJR0o1SUhSb1pTQmhjSEJzYVdOaFlteGxJR3hoZHl3Z1lXeHNJSE4xWTJnZ1EyOXVkR1Z1ZENCaGJtUWdjMlZ5ZG1salpYTWdZWEpsSUhCeWIzWnBaR1ZrSUc5dUlIUm9aU0FtY1hWdmREdGhjeUJwY3laeGRXOTBPeUJpWVhOcGN5NGdWR2hsSUVOdmJYQmhibmtnWkdselkyeGhhVzF6SUdGc2JDQjNZWEp5WVc1MGFXVnpJR0Z1WkNCamIyNWthWFJwYjI1eklISmxaMkZ5WkdsdVp5QjBhR2x6SUVOdmJuUmxiblFnWVc1a0lITmxjblpwWTJWekxDQnBibU5zZFdScGJtY2dkMkZ5Y21GdWRHbGxjeUJoYm1RZ2NISnZkbWx6YVc5dWN5QnZaaUJ0WlhKamFHRnVkR0ZpYVd4cGRIa3NJR1pwZEc1bGMzTWdabTl5SUdFZ1kyVnlkR0ZwYmlCd2RYSndiM05sTGp4aWNpQXZQZ284WW5JZ0x6NEtWRzhnZEdobElHMWhlR2x0ZFcwZ1pYaDBaVzUwSUhCbGNtMXBkSFJsWkNCaWVTQjBhR1VnWVhCd2JHbGpZV0pzWlNCc1lYY3NJR2x1SUc1dklHVjJaVzUwSUhOb1lXeHNJSFJvWlNCRGIyMXdZVzU1SUdKbElHeHBZV0pzWlNCbWIzSWdZVzU1SUdScGNtVmpkQ3dnYVc1a2FYSmxZM1FzSUdsdVkybGtaVzUwWVd3c0lHTnZibk5sY1hWbGJuUnBZV3dzSUhOd1pXTnBZV3dzSUhCMWJtbDBhWFpsSUdSaGJXRm5aWE1nYVc1amJIVmthVzVuTENCaWRYUWdibTkwSUd4cGJXbDBaV1FnZEc4c0lHUmhiV0ZuWlhNZ1ptOXlJR3h2YzNNZ2IyWWdaVzVxYjNsdFpXNTBMQ0JrWVhSaElHOXlJSEJ5YjJacGRITXNJR2x1SUhSb1pTQmpiMjV1WldOMGFXOXVJSGRwZEdnZ2RHaGxJR1Z1YW05NWJXVnVkQ0J2Y2lCbGVHVmpkWFJwYjI0Z2IyWWdkR2hsSUZOcGRHVWdhVzRnZEdobElHTnZiblJsZUhRZ2IyWWdkR2hsSUdsdVlXSnBiR2wwZVNCdmNpQmtaV3hoZVNCMGJ5QmxibXB2ZVNCMGFHVWdVMmwwWlNCdmNpQnBkSE1nYzJWeWRtbGpaWE1zSUc5eUlHWnZjaUJoYm5rZ1EyOXVkR1Z1ZENCdlppQjBhR1VnVTJsMFpTd2diM0lnYjNSb1pYSjNhWE5sSUdGeWFYTnBibWNnYjNWMElHOW1JSFJvWlNCbGJtcHZlVzFsYm5RZ2IyWWdkR2hsSUZOcGRHVXNJR0poYzJWa0lHOXVJR052Ym5SeVlXTjBJR0Z1WkNCdWIyNHRZMjl1ZEhKaFkzUWdiR2xoWW1sc2FYUjVJRzl5SUc5MGFHVnlJSEpsWVhOdmJpNDhZbklnTHo0S1BHSnlJQzgrQ2tsbUlIUm9aU0JsZUdOc2RYTnBiMjRnYjNJZ2JHbHRhWFJoZEdsdmJpQnZaaUJzYVdGaWFXeHBkSGtnWm05eUlHUmhiV0ZuWlhNc0lIZG9aWFJvWlhJZ1kyOXVjMlZ4ZFdWdWRHbGhiQ0J2Y2lCcGJtTnBaR1Z1ZEdGc0xDQmhjbVVnY0hKdmFHbGlhWFJsWkNCcGJpQmhJSEJoY25ScFkzVnNZWElnWTJGelpTd2dkR2hsSUdWNFkyeDFjMmx2YmlCdmNpQnNhVzFwZEdGMGFXOXVJRzltSUd4cFlXSnBiR2wwZVNCemFHRnNiQ0J1YjNRZ1lYQndiSGtnZEc4Z2VXOTFManhpY2lBdlBnbzhZbklnTHo0S1BITjBjbTl1Wno0NExpQkpUa1JGVFU1SlJrbERRVlJKVDA0OEwzTjBjbTl1Wno0OFluSWdMejRLUEdKeUlDOCtDbGx2ZFNCaFozSmxaU0IwYnlCcGJtUmxiVzVwWm5rc0lHUmxabVZ1WkNCaGJtUWdhRzlzWkNCb1lYSnRiR1Z6Y3lCMGFHVWdRMjl0Y0dGdWVTd2dhWFJ6SUcxaGJtRm5aWEp6TENCa2FYSmxZM1J2Y25Nc0lHVnRjR3h2ZVdWbGN5d2dZV2RsYm5SekxDQmhibVFnZEdocGNtUWdjR0Z5ZEdsbGN5d2dabTl5SUdGdWVTQmpiM04wY3l3Z2JHOXpjMlZ6TENCbGVIQmxibk5sY3lBb2FXNWpiSFZrYVc1bklHRjBkRzl5Ym1WNWN5WWpNems3SUdabFpYTXBMQ0JzYVdGaWFXeHBkR2xsY3lCeVpXZGhjbVJwYm1jZ2IzSWdZWEpwYzJsdVp5QnZkWFFnYjJZZ2VXOTFjaUJsYm1wdmVXMWxiblFnYjJZZ2IzSWdhVzVoWW1sc2FYUjVJSFJ2SUdWdWFtOTVJSFJvWlNCVGFYUmxJRzl5SUdsMGN5QnpaWEoyYVdObGN5QmhibVFnUTI5dGNHRnVlU1p5YzNGMWJ6dHpJSE5sY25acFkyVnpJR0Z1WkNCd2NtOWtkV04wY3l3Z2VXOTFjaUIyYVc5c1lYUnBiMjRnYjJZZ2RHaGxJRlJsY20xeklHOXlJSGx2ZFhJZ2RtbHZiR0YwYVc5dUlHOW1JR0Z1ZVNCeWFXZG9kSE1nYjJZZ2RHaHBjbVFnY0dGeWRHbGxjeXdnYjNJZ2VXOTFjaUIyYVc5c1lYUnBiMjRnYjJZZ2RHaGxJR0Z3Y0d4cFkyRmliR1VnYkdGM0xpQlVhR1VnYldGNUlHRnpjM1Z0WlNCMGFHVWdaWGhqYkhWemFYWmxJR1JsWm1WdWMyVWdZVzVrSUhsdmRTQnphR0ZzYkNCamIyOXdaWEpoZEdVZ2QybDBhQ0IwYUdVZ1EyOXRjR0Z1ZVNCcGJpQmhjM05sY25ScGJtY2dZVzU1SUdGMllXbHNZV0pzWlNCa1pXWmxibk5sY3k0OFluSWdMejRLUEdKeUlDOCtDanh6ZEhKdmJtYytPUzRnVkVWU1RVbE9RVlJKVDA0Z1FVNUVJRUZEUTBWVFV5QlNSVk5VVWtsRFZFbFBUand2YzNSeWIyNW5QanhpY2lBdlBnbzhZbklnTHo0S1ZHaGxJRU52YlhCaGJua2diV0Y1SUhSbGNtMXBibUYwWlNCNWIzVnlJR0ZqWTJWemN5QmhibVFnWVdOamIzVnVkQ0IwYnlCMGFHVWdVMmwwWlNCaGJtUWdhWFJ6SUhKbGJHRjBaV1FnYzJWeWRtbGpaWE1nYjNJZ1lXNTVJSEJoY25RZ1lYUWdZVzU1SUhScGJXVXNJSGRwZEdodmRYUWdibTkwYVdObExDQnBiaUJqWVhObElHOW1JSGx2ZFhJZ2RtbHZiR0YwYVc5dUlHOW1JSFJvWlNCVVpYSnRjeTQ4WW5JZ0x6NEtQR0p5SUM4K0NqeHpkSEp2Ym1jK01UQXVJRTFKVTBORlRFeEJUa1ZQVlZNOEwzTjBjbTl1Wno0OFluSWdMejRLUEdKeUlDOCtDbFJvWlNCbmIzWmxjbTVwYm1jZ2JHRjNJRzltSUhSb1pTQlVaWEp0Y3lCemFHRnNiQ0JpWlNCMGFHVWdjM1ZpYzNSaGJuUnBkbVVnYkdGM2N5QnZaaUIwYUdVZ1kyOTFiblJ5ZVNCM2FHVnlaU0IwYUdVZ1EyOXRjR0Z1ZVNCcGN5QnpaWFFnZFhBc0lHVjRZMlZ3ZENCMGFHVWdZMjl1Wm14cFkzUWdiMllnYkdGM2N5QnlkV3hsY3k0Z1dXOTFJSE5vWVd4c0lHNXZkQ0IxYzJVZ2RHaGxJRk5wZEdVZ2FXNGdhblZ5YVhOa2FXTjBhVzl1Y3lCMGFHRjBJR1J2SUc1dmRDQm5hWFpsSUdWbVptVmpkQ0IwYnlCaGJHd2djSEp2ZG1semFXOXVjeUJ2WmlCMGFHVWdWR1Z5YlhNdVBHSnlJQzgrQ2p4aWNpQXZQZ3BPYnlCcWIybHVkQ0IyWlc1MGRYSmxMQ0J3WVhKMGJtVnljMmhwY0N3Z1pXMXdiRzk1YldWdWRDd2diM0lnWVdkbGJtTjVJSEpsYkdGMGFXOXVjMmhwY0NCemFHRnNiQ0JpWlNCcGJYQnNhV1ZrSUdKbGRIZGxaVzRnZVc5MUlHRnVaQ0IwYUdVZ1EyOXRjR0Z1ZVNCaGN5QmhJSEpsYzNWc2RDQnZaaUIwYUdVZ1ZHVnliWE1nYjNJZ2RYTmxJRzltSUhSb1pTQlRhWFJsTGp4aWNpQXZQZ284WW5JZ0x6NEtUbTkwYUdsdVp5QnBiaUIwYUdVZ1ZHVnliWE1nYzJoaGJHd2dZbVVnWVNCa1pYSnZaMkYwYVc5dUlHOW1JSFJvWlNCRGIyMXdZVzU1SmlNek9UdHpJSEpwWjJoMElIUnZJR052YlhCc2VTQjNhWFJvSUdkdmRtVnlibTFsYm5SaGJDd2dZMjkxY25Rc0lIQnZiR2xqWlN3Z1lXNWtJR3hoZHlCbGJtWnZjbU5sYldWdWRDQnlaWEYxWlhOMGN5QnZjaUJ5WlhGMWFYSmxiV1Z1ZEhNZ2NtVm5ZWEprYVc1bklIbHZkWElnWlc1cWIzbHRaVzUwSUc5bUlIUm9aU0JUYVhSbExqeGljaUF2UGdwSlppQmhibmtnY0dGeWRDQnZaaUIwYUdVZ1ZHVnliWE1nYVhNZ1pHVjBaWEp0YVc1bFpDQjBieUJpWlNCMmIybGtJRzl5SUhWdVpXNW1iM0pqWldGaWJHVWdhVzRnWVdOamIzSmtZVzVqWlNCM2FYUm9JR0Z3Y0d4cFkyRmliR1VnYkdGM0lIUm9aVzRnZEdobElIWnZhV1FnYjNJZ2RXNWxibVp2Y21ObFlXSnNaU0JqYkdGMWMyVnpJSGRwYkd3Z1ltVWdaR1ZsYldWa0lITjFjR1Z5YzJWa1pXUWdZbmtnZG1Gc2FXUWdZVzVrSUdWdVptOXlZMlZoWW14bElHTnNZWFZ6WlhNZ2MyaGhiR3dnWW1VZ2MybHRhV3hoY2lCMGJ5QjBhR1VnYjNKcFoybHVZV3dnZG1WeWMybHZiaUJ2WmlCMGFHVWdWR1Z5YlhNZ1lXNWtJRzkwYUdWeUlIQmhjblJ6SUdGdVpDQnpaV04wYVc5dWN5QnZaaUIwYUdVZ1ZHVnliWE1nYzJoaGJHd2dZbVVnWVhCd2JHbGpZV0pzWlNCMGJ5QjViM1VnWVc1a0lIUm9aU0JEYjIxd1lXNTVManhpY2lBdlBnbzhZbklnTHo0S1ZHaGxJRlJsY20xeklHTnZibk4wYVhSMWRHVWdkR2hsSUdWdWRHbHlaU0JoWjNKbFpXMWxiblFnWW1WMGQyVmxiaUI1YjNVZ1lXNWtJSFJvWlNCRGIyMXdZVzU1SUhKbFoyRnlaR2x1WnlCMGFHVWdaVzVxYjNsdFpXNTBJRzltSUhSb1pTQlRhWFJsSUdGdVpDQjBhR1VnVkdWeWJYTWdjM1Z3WlhKelpXUmxJR0ZzYkNCd2NtbHZjaUJ2Y2lCamIyMXRkVzVwWTJGMGFXOXVjeUJoYm1RZ2IyWm1aWEp6TENCM2FHVjBhR1Z5SUdWc1pXTjBjbTl1YVdNc0lHOXlZV3dnYjNJZ2QzSnBkSFJsYml3Z1ltVjBkMlZsYmlCNWIzVWdZVzVrSUhSb1pTQkRiMjF3WVc1NUxqeGljaUF2UGdwVWFHVWdRMjl0Y0dGdWVTQmhibVFnYVhSeklHRm1abWxzYVdGMFpYTWdjMmhoYkd3Z2JtOTBJR0psSUd4cFlXSnNaU0JtYjNJZ1lTQm1ZV2xzZFhKbElHOXlJR1JsYkdGNUlIUnZJR1oxYkdacGJDQnBkSE1nYjJKc2FXZGhkR2x2Ym5NZ2QyaGxjbVVnZEdobElHWmhhV3gxY21VZ2IzSWdaR1ZzWVhrZ2NtVnpkV3gwY3lCbWNtOXRJR0Z1ZVNCallYVnpaU0JpWlhsdmJtUWdRMjl0Y0dGdWVTWWpNems3Y3lCeVpXRnpiMjVoWW14bElHTnZiblJ5YjJ3c0lHbHVZMngxWkdsdVp5QjBaV05vYm1sallXd2dabUZwYkhWeVpYTXNJRzVoZEhWeVlXd2daR2x6WVhOMFpYSnpMQ0JpYkc5amEyRm5aWE1zSUdWdFltRnlaMjlsY3l3Z2NtbHZkSE1zSUdGamRITXNJSEpsWjNWc1lYUnBiMjRzSUd4bFoybHpiR0YwYVc5dUxDQnZjaUJ2Y21SbGNuTWdiMllnWjI5MlpYSnViV1Z1ZEN3Z2RHVnljbTl5YVhOMGFXTWdZV04wY3l3Z2QyRnlMQ0J2Y2lCaGJua2diM1JvWlhJZ1ptOXlZMlVnYjNWMGMybGtaU0J2WmlCRGIyMXdZVzU1SmlNek9UdHpJR052Ym5SeWIyd3VQR0p5SUM4K0NrbHVJR05oYzJVZ2IyWWdZMjl1ZEhKdmRtVnljMmxsY3l3Z1pHVnRZVzVrY3l3Z1kyeGhhVzF6TENCa2FYTndkWFJsY3l3Z2IzSWdZMkYxYzJWeklHOW1JR0ZqZEdsdmJpQmlaWFIzWldWdUlIUm9aU0JEYjIxd1lXNTVJR0Z1WkNCNWIzVWdjbVZzWVhScGJtY2dkRzhnZEdobElGTnBkR1VnYjNJZ2IzUm9aWElnY21Wc1lYUmxaQ0JwYzNOMVpYTXNJRzl5SUhSb1pTQlVaWEp0Y3l3Z2VXOTFJR0Z1WkNCMGFHVWdRMjl0Y0dGdWVTQmhaM0psWlNCMGJ5QmhkSFJsYlhCMElIUnZJSEpsYzI5c2RtVWdjM1ZqYUNCamIyNTBjbTkyWlhKemFXVnpMQ0JrWlcxaGJtUnpMQ0JqYkdGcGJYTXNJR1JwYzNCMWRHVnpMQ0J2Y2lCallYVnpaWE1nYjJZZ1lXTjBhVzl1SUdKNUlHZHZiMlFnWm1GcGRHZ2dibVZuYjNScFlYUnBiMjRzSUdGdVpDQnBiaUJqWVhObElHOW1JR1poYVd4MWNtVWdiMllnYzNWamFDQnVaV2R2ZEdsaGRHbHZiaXdnWlhoamJIVnphWFpsYkhrZ2RHaHliM1ZuYUNCMGFHVWdZMjkxY25SeklHOW1JSFJvWlNCamIzVnVkSEo1SUhkb1pYSmxJSFJvWlNCRGIyMXdZVzU1SUdseklITmxkQ0IxY0M0OFluSWdMejRLUEdKeUlDOCtDanh6ZEhKdmJtYytNVEV1SUVOUFRWQk1RVWxPVkZNOEwzTjBjbTl1Wno0OFluSWdMejRLUEdKeUlDOCtDbGRsSUdGeVpTQmpiMjF0YVhSMFpXUWdkRzhnY21WemIyeDJaU0JoYm5rZ1kyOXRjR3hoYVc1MGN5QmhZbTkxZENCdmRYSWdZMjlzYkdWamRHbHZiaUJ2Y2lCMWMyVWdiMllnZVc5MWNpQndaWEp6YjI1aGJDQmtZWFJoTGlCSlppQjViM1VnZDI5MWJHUWdiR2xyWlNCMGJ5QnRZV3RsSUdFZ1kyOXRjR3hoYVc1MElISmxaMkZ5WkdsdVp5QjBhR2x6SUNadVluTndPMVJsY20xeklHOXlJRzkxY2lCd2NtRmpkR2xqWlhNZ2FXNGdjbVZzWVhScGIyNGdkRzhnZVc5MWNpQndaWEp6YjI1aGJDQmtZWFJoTENCd2JHVmhjMlVnWTI5dWRHRmpkQ0IxY3lCaGREb2dZV1J0YVc1QWRYTjBZWGh5Wld4cFpXWmhaMlZ1WTNrdVkyOXRMaUJYWlNCM2FXeHNJSEpsY0d4NUlIUnZJSGx2ZFhJZ1kyOXRjR3hoYVc1MElHRnpJSE52YjI0Z1lYTWdkMlVnWTJGdUlHRnVaQ0JwYmlCaGJua2daWFpsYm5Rc0lIZHBkR2hwYmlBek1DQmtZWGx6TGlCWFpTQm9iM0JsSUhSdklISmxjMjlzZG1VZ1lXNTVJR052YlhCc1lXbHVkQ0JpY205MVoyaDBJSFJ2SUc5MWNpQmhkSFJsYm5ScGIyNHNJR2h2ZDJWMlpYSWdhV1lnZVc5MUlHWmxaV3dnZEdoaGRDQjViM1Z5SUdOdmJYQnNZV2x1ZENCb1lYTWdibTkwSUdKbFpXNGdZV1JsY1hWaGRHVnNlU0J5WlhOdmJIWmxaQ3dnZVc5MUlISmxjMlZ5ZG1VZ2RHaGxJSEpwWjJoMElIUnZJR052Ym5SaFkzUWdlVzkxY2lCc2IyTmhiQ0JrWVhSaElIQnliM1JsWTNScGIyNGdjM1Z3WlhKMmFYTnZjbmtnWVhWMGFHOXlhWFI1TGp4aWNpQXZQZ284WW5JZ0x6NEtQSE4wY205dVp6NHhNaTRnUTA5T1ZFRkRWQ0JKVGtaUFVrMUJWRWxQVGp3dmMzUnliMjVuUGp4aWNpQXZQZ3BYWlNCM1pXeGpiMjFsSUhsdmRYSWdZMjl0YldWdWRITWdiM0lnY1hWbGMzUnBiMjV6SUdGaWIzVjBJSFJvYVhNZ0ptNWljM0E3VkdWeWJYTXVJRmx2ZFNCdFlYa2dZMjl1ZEdGamRDQjFjeUJwYmlCM2NtbDBhVzVuSUdGMElEeGhJR2h5WldZOUltMWhhV3gwYnpwaFpHMXBia0IxYzNSaGVISmxiR2xsWm1GblpXNWplUzVqYjIwL2MzVmlhbVZqZEQxVlV5VXlNRlJoZUNVeU1GSmxabXhwWldZbE1qQkJaMlZ1WTNraUlIUmhjbWRsZEQwaVgySnNZVzVySWo1aFpHMXBia0IxYzNSaGVISmxiR2xsWm1GblpXNWplUzVqYjIwOEwyRStJRzl5SURNNE16QWdWeTRnTnpOeVpDQkJkbVZ1ZFdVZ0l6SXdNaXdnVjJWemRHMXBibk4wWlhJc0lFTlBJRGd3TURNOEwzQStDZz09IiwicHJpdmFjeSI6IlBIQWdjM1I1YkdVOUluUmxlSFF0WVd4cFoyNDZJR05sYm5SbGNqc2lQanh6ZEhKdmJtYytWVk1nVkdGNElGSmxiR2xsWmlCQloyVnVZM2tnVUhKcGRtRmplU0JRYjJ4cFkzazhZbklnTHo0S1RHRnpkQ0JWY0dSaGRHVmtPaUJCZFdkMWMzUWdNVFVzSURJd01UZzhMM04wY205dVp6NDhMM0ErQ2dvOGNENDhZbklnTHo0S1BITjBjbTl1Wno1SlRsUlNUMFJWUTFSSlQwNDhMM04wY205dVp6NDhZbklnTHo0S1BHSnlJQzgrQ2xSb2FYTWdjSEpwZG1GamVTQndiMnhwWTNrZ0tDWnNaSEYxYnpzOGMzUnliMjVuUGxCdmJHbGplVHd2YzNSeWIyNW5QaVp5WkhGMWJ6c3BJR1JsYzJOeWFXSmxjeUJvYjNjZ1ZWTWdWR0Y0SUZKbGJHbGxaaUJCWjJWdVkza3NJRE00TXpBZ1Z5NGdOek55WkNCQmRtVXNJRk4xYVhSbElESXdNaXdnVjJWemRHMXBibk4wWlhJc0lFTlBJRGd3TURNd0lDZ21iR1J4ZFc4N1BITjBjbTl1Wno1RGIyMXdZVzU1UEM5emRISnZibWMrTENaeVpIRjFienNnSm14a2NYVnZPenh6ZEhKdmJtYytkMlU4TDNOMGNtOXVaejRzSm5Ka2NYVnZPeUJoYm1RZ0pteGtjWFZ2T3p4emRISnZibWMrYjNWeVBDOXpkSEp2Ym1jK0puSmtjWFZ2T3lrZ2NISnZZMlZ6YzJWekxDQmpiMnhzWldOMGN5d2dkWE5sY3lCaGJtUWdjMmhoY21WeklIQmxjbk52Ym1Gc0lHUmhkR0VnZDJobGJpQjFjMmx1WnlCMGFHbHpJSGRsWW5OcGRHVWdkM2QzTG5Sb1pXRnNZMmhsYlhsamIyNXpkV3gwYVc1blozSnZkWEF1WTI5dElDaDBhR1VnSm14a2NYVnZPenh6ZEhKdmJtYytVMmwwWlR3dmMzUnliMjVuUGlaeVpIRjFienNwTGlCUWJHVmhjMlVnY21WaFpDQjBhR1VnWm05c2JHOTNhVzVuSUdsdVptOXliV0YwYVc5dUlHTmhjbVZtZFd4c2VTQjBieUIxYm1SbGNuTjBZVzVrSUc5MWNpQndjbUZqZEdsalpYTWdjbVZuWVhKa2FXNW5JSGx2ZFhJZ2NHVnljMjl1WVd3Z1pHRjBZU0JoYm1RZ2FHOTNJSGRsSUhkcGJHd2djSEp2WTJWemN5QmtZWFJoTGp4aWNpQXZQZ284WW5JZ0x6NEtQSE4wY205dVp6NHhMaUJRVlZKUVQxTkZVeUJQUmlCUVVrOURSVk5UU1U1SFBDOXpkSEp2Ym1jK1BHSnlJQzgrQ2p4aWNpQXZQZ284YzNSeWIyNW5QbGRvWVhRZ2FYTWdjR1Z5YzI5dVlXd2daR0YwWVQ4OEwzTjBjbTl1Wno0OFluSWdMejRLUEdKeUlDOCtDbGRsSUdOdmJHeGxZM1FnYVc1bWIzSnRZWFJwYjI0Z1lXSnZkWFFnZVc5MUlHbHVJR0VnY21GdVoyVWdiMllnWm05eWJYTXNJR2x1WTJ4MVpHbHVaeUJ3WlhKemIyNWhiQ0JrWVhSaExpQkJjeUIxYzJWa0lHbHVJSFJvYVhNZ1VHOXNhV041TENBbWJHUnhkVzg3Y0dWeWMyOXVZV3dnWkdGMFlTWnlaSEYxYnpzZ2FYTWdZWE1nWkdWbWFXNWxaQ0JwYmlCMGFHVWdSMlZ1WlhKaGJDQkVZWFJoSUZCeWIzUmxZM1JwYjI0Z1VtVm5kV3hoZEdsdmJpd2dkR2hwY3lCcGJtTnNkV1JsY3lCaGJua2dhVzVtYjNKdFlYUnBiMjRnZDJocFkyZ3NJR1ZwZEdobGNpQmhiRzl1WlNCdmNpQnBiaUJqYjIxaWFXNWhkR2x2YmlCM2FYUm9JRzkwYUdWeUlHbHVabTl5YldGMGFXOXVJSGRsSUhCeWIyTmxjM01nWVdKdmRYUWdlVzkxTENCcFpHVnVkR2xtYVdWeklIbHZkU0JoY3lCaGJpQnBibVJwZG1sa2RXRnNMQ0JwYm1Oc2RXUnBibWNzSUdadmNpQmxlR0Z0Y0d4bExDQjViM1Z5SUc1aGJXVXNJSEJ2YzNSaGJDQmhaR1J5WlhOekxDQmxiV0ZwYkNCaFpHUnlaWE56SUdGdVpDQjBaV3hsY0dodmJtVWdiblZ0WW1WeUxpWnVZbk53T3p4aWNpQXZQZ284WW5JZ0x6NEtQSE4wY205dVp6NVhhSGtnWkc4Z2QyVWdibVZsWkNCNWIzVnlJSEJsY25OdmJtRnNJR1JoZEdFL1BDOXpkSEp2Ym1jK1BHSnlJQzgrQ2p4aWNpQXZQZ3BYWlNCM2FXeHNJRzl1YkhrZ2NISnZZMlZ6Y3lCNWIzVnlJSEJsY25OdmJtRnNJR1JoZEdFZ2FXNGdZV05qYjNKa1lXNWpaU0IzYVhSb0lHRndjR3hwWTJGaWJHVWdaR0YwWVNCd2NtOTBaV04wYVc5dUlHRnVaQ0J3Y21sMllXTjVJR3hoZDNNdUlGZGxJRzVsWldRZ1kyVnlkR0ZwYmlCd1pYSnpiMjVoYkNCa1lYUmhJR2x1SUc5eVpHVnlJSFJ2SUhCeWIzWnBaR1VnZVc5MUlIZHBkR2dnWVdOalpYTnpJSFJ2SUhSb1pTQlRhWFJsTGlCSlppQjViM1VnY21WbmFYTjBaWEpsWkNCM2FYUm9JSFZ6TENCNWIzVWdkMmxzYkNCb1lYWmxJR0psWlc0Z1lYTnJaV1FnZEc4Z2RHbGpheUIwYnlCaFozSmxaU0IwYnlCd2NtOTJhV1JsSUhSb2FYTWdhVzVtYjNKdFlYUnBiMjRnYVc0Z2IzSmtaWElnZEc4Z1lXTmpaWE56SUc5MWNpQnpaWEoyYVdObGN5d2djSFZ5WTJoaGMyVWdiM1Z5SUhCeWIyUjFZM1J6TENCdmNpQjJhV1YzSUc5MWNpQmpiMjUwWlc1MExpQlVhR2x6SUdOdmJuTmxiblFnY0hKdmRtbGtaWE1nZFhNZ2QybDBhQ0IwYUdVZ2JHVm5ZV3dnWW1GemFYTWdkMlVnY21WeGRXbHlaU0IxYm1SbGNpQmhjSEJzYVdOaFlteGxJR3hoZHlCMGJ5QndjbTlqWlhOeklIbHZkWElnWkdGMFlTNGdXVzkxSUcxaGFXNTBZV2x1SUhSb1pTQnlhV2RvZENCMGJ5QjNhWFJvWkhKaGR5QnpkV05vSUdOdmJuTmxiblFnWVhRZ1lXNTVJSFJwYldVdUlFbG1JSGx2ZFNCa2J5QnViM1FnWVdkeVpXVWdkRzhnYjNWeUlIVnpaU0J2WmlCNWIzVnlJSEJsY25OdmJtRnNJR1JoZEdFZ2FXNGdiR2x1WlNCM2FYUm9JSFJvYVhNZ1VHOXNhV041TENCd2JHVmhjMlVnWkc4Z2JtOTBJSFZ6WlNCdmRYSWdVMmwwWlM0OFluSWdMejRLUEdKeUlDOCtDanh6ZEhKdmJtYytNaTRnUTA5TVRFVkRWRWxPUnlCWlQxVlNJRkJGVWxOUFRrRk1JRVJCVkVFOEwzTjBjbTl1Wno0OEwzQStDZ284Y0Q1WFpTQmpiMnhzWldOMElHbHVabTl5YldGMGFXOXVJR0ZpYjNWMElIbHZkU0JwYmlCMGFHVWdabTlzYkc5M2FXNW5JSGRoZVhNNlBHSnlJQzgrQ2p4aWNpQXZQZ284YzNSeWIyNW5Qa2x1Wm05eWJXRjBhVzl1SUZsdmRTQkhhWFpsSUZWelBDOXpkSEp2Ym1jK0xpQlVhR2x6SUdsdVkyeDFaR1Z6T2p3dmNENEtDangxYkQ0S0NUeHNhVDUwYUdVZ2NHVnljMjl1WVd3Z1pHRjBZU0I1YjNVZ2NISnZkbWxrWlNCM2FHVnVJSGx2ZFNCeVpXZHBjM1JsY2lCMGJ5QjFjMlVnYjNWeUlGTnBkR1VzSUdsdVkyeDFaR2x1WnlCNWIzVnlKbXh5YlRzZ2JtRnRaU3dnY0c5emRHRnNJR0ZrWkhKbGMzTXNJR1Z0WVdsc0lHRmtaSEpsYzNNc0lIUmxiR1Z3YUc5dVpTQnVkVzFpWlhJc0lIVnpaWEp1WVcxbExDQndZWE56ZDI5eVpDQmhibVFnWkdWdGIyZHlZWEJvYVdNZ2FXNW1iM0p0WVhScGIyNGdLSE4xWTJnZ1lYTWdlVzkxY2lCblpXNWtaWElwT3ladVluTndPend2YkdrK0NnazhiR2srZEdobElIQmxjbk52Ym1Gc0lHUmhkR0VnZVc5MUlIQnliM1pwWkdVZ2FXNGdZMjl1Ym1WamRHbHZiaUIzYVhSb0lHOTFjaUJ5WlhkaGNtUnpJSEJ5YjJkeVlXMGdZVzVrSUc5MGFHVnlJSEJ5YjIxdmRHbHZibk1nZDJVZ2NuVnVJRzl1SUhSb1pTQlRhWFJsT3p3dmJHaytDZ2s4YkdrK2RHaGxJSEJsY25OdmJtRnNJR1JoZEdFZ2VXOTFJSEJ5YjNacFpHVWdkMmhsYmlCNWIzVWdjbVZ3YjNKMElHRWdjSEp2WW14bGJTQjNhWFJvSUc5MWNpQlRhWFJsSUc5eUlIZG9aVzRnZDJVZ2NISnZkbWxrWlNCNWIzVWdkMmwwYUNCamRYTjBiMjFsY2lCemRYQndiM0owT3ladVluTndPend2YkdrK0NnazhiR2srZEdobElIQmxjbk52Ym1Gc0lHUmhkR0VnZVc5MUlIQnliM1pwWkdVZ2QyaGxiaUI1YjNVZ2JXRnJaU0JoSUhCMWNtTm9ZWE5sSUhSb2IzSnZkV2RvSUc5MWNpQlRhWFJsT3lCaGJtUThMMnhwUGdvSlBHeHBQblJvWlNCd1pYSnpiMjVoYkNCa1lYUmhJSGx2ZFNCd2NtOTJhV1JsSUhkb1pXNGdlVzkxSUdOdmNuSmxjM0J2Ym1RZ2QybDBhQ0IxY3lCaWVTQndhRzl1WlN3Z1pXMWhhV3dnYjNJZ2IzUm9aWEozYVhObExqd3ZiR2srQ2p3dmRXdytDZ284Y0Q0OGMzUnliMjVuUGtsdVptOXliV0YwYVc5dUlHWnliMjBnVTI5amFXRnNJRTVsZEhkdmNtdHBibWNnVTJsMFpYTThMM04wY205dVp6NHVJRTkxY2lCVGFYUmxJR2x1WTJ4MVpHVWdhVzUwWlhKbVlXTmxjeUIwYUdGMElHRnNiRzkzSUhsdmRTQjBieUJqYjI1dVpXTjBJSGRwZEdnZ2MyOWphV0ZzSUc1bGRIZHZjbXRwYm1jZ2MybDBaWE1nS0dWaFkyZ2dZU0FtYkdSeGRXODdVMDVUSm5Ka2NYVnZPeWt1SUVsbUlIbHZkU0JqYjI1dVpXTjBJSFJ2SUdFZ1UwNVRJSFJvY205MVoyZ2diM1Z5SUZOcGRHVXNJSGx2ZFNCaGRYUm9iM0pwZW1VZ2RYTWdkRzhnWVdOalpYTnpMQ0IxYzJVZ1lXNWtJSE4wYjNKbElIUm9aU0JwYm1admNtMWhkR2x2YmlCMGFHRjBJSGx2ZFNCaFozSmxaV1FnZEdobElGTk9VeUJqYjNWc1pDQndjbTkyYVdSbElIUnZJSFZ6SUdKaGMyVmtJRzl1SUhsdmRYSWdjMlYwZEdsdVozTWdiMjRnZEdoaGRDQlRUbE11SUZkbElIZHBiR3dnWVdOalpYTnpMQ0IxYzJVZ1lXNWtJSE4wYjNKbElIUm9ZWFFnYVc1bWIzSnRZWFJwYjI0Z2FXNGdZV05qYjNKa1lXNWpaU0IzYVhSb0lIUm9hWE1nVUc5c2FXTjVMaUJaYjNVZ1kyRnVJSEpsZG05clpTQnZkWElnWVdOalpYTnpJSFJ2SUhSb1pTQnBibVp2Y20xaGRHbHZiaUI1YjNVZ2NISnZkbWxrWlNCcGJpQjBhR2x6SUhkaGVTQmhkQ0JoYm5rZ2RHbHRaU0JpZVNCaGJXVnVaR2x1WnlCMGFHVWdZWEJ3Y205d2NtbGhkR1VnYzJWMGRHbHVaM01nWm5KdmJTQjNhWFJvYVc0Z2VXOTFjaUJoWTJOdmRXNTBJSE5sZEhScGJtZHpJRzl1SUhSb1pTQmhjSEJzYVdOaFlteGxJRk5PVXk0OFluSWdMejRLUEdKeUlDOCtDanh6ZEhKdmJtYytTVzVtYjNKdFlYUnBiMjRnUVhWMGIyMWhkR2xqWVd4c2VTQkRiMnhzWldOMFpXUThMM04wY205dVp6NHVJRmRsSUdGMWRHOXRZWFJwWTJGc2JIa2diRzluSUdsdVptOXliV0YwYVc5dUlHRmliM1YwSUhsdmRTQmhibVFnZVc5MWNpQmpiMjF3ZFhSbGNpQnZjaUJ0YjJKcGJHVWdaR1YyYVdObElIZG9aVzRnZVc5MUlHRmpZMlZ6Y3lCdmRYSWdVMmwwWlM0Z1JtOXlJR1Y0WVcxd2JHVXNJSGRvWlc0Z2RtbHphWFJwYm1jZ2IzVnlJRk5wZEdVc0lIZGxJR3h2WnlCNWIzVnlJR052YlhCMWRHVnlJRzl5SUcxdlltbHNaU0JrWlhacFkyVWdiM0JsY21GMGFXNW5JSE41YzNSbGJTQnVZVzFsSUdGdVpDQjJaWEp6YVc5dUxDQnRZVzUxWm1GamRIVnlaWElnWVc1a0lHMXZaR1ZzTENCaWNtOTNjMlZ5SUhSNWNHVXNJR0p5YjNkelpYSWdiR0Z1WjNWaFoyVXNJSE5qY21WbGJpQnlaWE52YkhWMGFXOXVMQ0IwYUdVZ2QyVmljMmwwWlNCNWIzVWdkbWx6YVhSbFpDQmlaV1p2Y21VZ1luSnZkM05wYm1jZ2RHOGdiM1Z5SUZOcGRHVXNJSEJoWjJWeklIbHZkU0IyYVdWM1pXUXNJR2h2ZHlCc2IyNW5JSGx2ZFNCemNHVnVkQ0J2YmlCaElIQmhaMlVzSUdGalkyVnpjeUIwYVcxbGN5QmhibVFnYVc1bWIzSnRZWFJwYjI0Z1lXSnZkWFFnZVc5MWNpQjFjMlVnYjJZZ1lXNWtJR0ZqZEdsdmJuTWdiMjRnYjNWeUlGTnBkR1V1SUZkbElHTnZiR3hsWTNRZ2RHaHBjeUJwYm1admNtMWhkR2x2YmlCaFltOTFkQ0I1YjNVZ2RYTnBibWNnWTI5dmEybGxjeTQ4WW5JZ0x6NEtQR0p5SUM4K0NqeHpkSEp2Ym1jK1FYVjBiMjFoZEdWa0lFUmxZMmx6YVc5dUlFMWhhMmx1WnlCaGJtUWdVSEp2Wm1sc2FXNW5Mand2YzNSeWIyNW5QanhpY2lBdlBnbzhZbklnTHo0S1YyVWdaRzhnYm05MElIVnpaU0I1YjNWeUlIQmxjbk52Ym1Gc0lHUmhkR0VnWm05eUlIUm9aU0J3ZFhKd2IzTmxjeUJ2WmlCaGRYUnZiV0YwWldRZ1pHVmphWE5wYjI0dGJXRnJhVzVuTGlCSWIzZGxkbVZ5TENCM1pTQnRZWGtnWkc4Z2MyOGdhVzRnYjNKa1pYSWdkRzhnWm5Wc1ptbHNJRzlpYkdsbllYUnBiMjV6SUdsdGNHOXpaV1FnWW5rZ2JHRjNMQ0JwYmlCM2FHbGphQ0JqWVhObElIZGxJSGRwYkd3Z2FXNW1iM0p0SUhsdmRTQnZaaUJoYm5rZ2MzVmphQ0J3Y205alpYTnphVzVuSUdGdVpDQndjbTkyYVdSbElIbHZkU0IzYVhSb0lHRnVJRzl3Y0c5eWRIVnVhWFI1SUhSdklHOWlhbVZqZEM0OFluSWdMejRLUEdKeUlDOCtDanh6ZEhKdmJtYytNeTRtYm1KemNEdERUMDlMU1VWVFBDOXpkSEp2Ym1jK1BHSnlJQzgrQ2p4aWNpQXZQZ284YzNSeWIyNW5QbGRvWVhRZ1lYSmxJR052YjJ0cFpYTS9QQzl6ZEhKdmJtYytQR0p5SUM4K0NqeGljaUF2UGdwWFpTQnRZWGtnWTI5c2JHVmpkQ0JwYm1admNtMWhkR2x2YmlCMWMybHVaeUFtYkdSeGRXODdZMjl2YTJsbGN5NG1jbVJ4ZFc4N0lFTnZiMnRwWlhNZ1lYSmxJSE50WVd4c0lHUmhkR0VnWm1sc1pYTWdjM1J2Y21Wa0lHOXVJSFJvWlNCb1lYSmtJR1J5YVhabElHOW1JSGx2ZFhJZ1kyOXRjSFYwWlhJZ2IzSWdiVzlpYVd4bElHUmxkbWxqWlNCaWVTQmhJSGRsWW5OcGRHVXVJRmRsSUcxaGVTQjFjMlVnWW05MGFDQnpaWE56YVc5dUlHTnZiMnRwWlhNZ0tIZG9hV05vSUdWNGNHbHlaU0J2Ym1ObElIbHZkU0JqYkc5elpTQjViM1Z5SUhkbFlpQmljbTkzYzJWeUtTQmhibVFnY0dWeWMybHpkR1Z1ZENCamIyOXJhV1Z6SUNoM2FHbGphQ0J6ZEdGNUlHOXVJSGx2ZFhJZ1kyOXRjSFYwWlhJZ2IzSWdiVzlpYVd4bElHUmxkbWxqWlNCMWJuUnBiQ0I1YjNVZ1pHVnNaWFJsSUhSb1pXMHBJSFJ2SUhCeWIzWnBaR1VnZVc5MUlIZHBkR2dnWVNCdGIzSmxJSEJsY25OdmJtRnNJR0Z1WkNCcGJuUmxjbUZqZEdsMlpTQmxlSEJsY21sbGJtTmxJRzl1SUc5MWNpQlRhWFJsTGp4aWNpQXZQZ284WW5JZ0x6NEtWMlVnZFhObElIUjNieUJpY205aFpDQmpZWFJsWjI5eWFXVnpJRzltSUdOdmIydHBaWE02SUNneEtTQm1hWEp6ZENCd1lYSjBlU0JqYjI5cmFXVnpMQ0J6WlhKMlpXUWdaR2x5WldOMGJIa2dZbmtnZFhNZ2RHOGdlVzkxY2lCamIyMXdkWFJsY2lCdmNpQnRiMkpwYkdVZ1pHVjJhV05sTENCM2FHbGphQ0JoY21VZ2RYTmxaQ0J2Ym14NUlHSjVJSFZ6SUhSdklISmxZMjluYm1sNlpTQjViM1Z5SUdOdmJYQjFkR1Z5SUc5eUlHMXZZbWxzWlNCa1pYWnBZMlVnZDJobGJpQnBkQ0J5WlhacGMybDBjeUJ2ZFhJZ1UybDBaVHNnWVc1a0lDZ3lLU0IwYUdseVpDQndZWEowZVNCamIyOXJhV1Z6TENCM2FHbGphQ0JoY21VZ2MyVnlkbVZrSUdKNUlITmxjblpwWTJVZ2NISnZkbWxrWlhKeklHOXVJRzkxY2lCVGFYUmxMQ0JoYm1RZ1kyRnVJR0psSUhWelpXUWdZbmtnYzNWamFDQnpaWEoyYVdObElIQnliM1pwWkdWeWN5QjBieUJ5WldOdloyNXBlbVVnZVc5MWNpQmpiMjF3ZFhSbGNpQnZjaUJ0YjJKcGJHVWdaR1YyYVdObElIZG9aVzRnYVhRZ2RtbHphWFJ6SUc5MGFHVnlJSGRsWW5OcGRHVnpManhpY2lBdlBnbzhZbklnTHo0S1BITjBjbTl1Wno1RGIyOXJhV1Z6SUhkbElIVnpaVHd2YzNSeWIyNW5QanhpY2lBdlBnbzhZbklnTHo0S1QzVnlJRk5wZEdVZ2RYTmxjeUIwYUdVZ1ptOXNiRzkzYVc1bklIUjVjR1Z6SUc5bUlHTnZiMnRwWlhNZ1ptOXlJSFJvWlNCd2RYSndiM05sY3lCelpYUWdiM1YwSUdKbGJHOTNPand2Y0Q0S0NqeDBZV0pzWlQ0S0NUeDBZbTlrZVQ0S0NRazhkSEkrQ2drSkNUeDBhRDVVZVhCbElHOW1JR052YjJ0cFpUd3ZkR2crQ2drSkNUeDBhRDVRZFhKd2IzTmxQQzkwYUQ0S0NRazhMM1J5UGdvSkNUeDBjajRLQ1FrSlBIUmtQa1Z6YzJWdWRHbGhiQ0JEYjI5cmFXVnpQQzkwWkQ0S0NRa0pQSFJrUGxSb1pYTmxJR052YjJ0cFpYTWdZWEpsSUdWemMyVnVkR2xoYkNCMGJ5QndjbTkyYVdSbElIbHZkU0IzYVhSb0lITmxjblpwWTJWeklHRjJZV2xzWVdKc1pTQjBhSEp2ZFdkb0lHOTFjaUJUYVhSbElHRnVaQ0IwYnlCbGJtRmliR1VnZVc5MUlIUnZJSFZ6WlNCemIyMWxJRzltSUdsMGN5Qm1aV0YwZFhKbGN5NGdSbTl5SUdWNFlXMXdiR1VzSUhSb1pYa2dZV3hzYjNjZ2VXOTFJSFJ2SUd4dlp5QnBiaUIwYnlCelpXTjFjbVVnWVhKbFlYTWdiMllnYjNWeUlGTnBkR1VnWVc1a0lHaGxiSEFnZEdobElHTnZiblJsYm5RZ2IyWWdkR2hsSUhCaFoyVnpJSGx2ZFNCeVpYRjFaWE4wSUd4dllXUWdjWFZwWTJ0c2VTNGdWMmwwYUc5MWRDQjBhR1Z6WlNCamIyOXJhV1Z6TENCMGFHVWdjMlZ5ZG1salpYTWdkR2hoZENCNWIzVWdhR0YyWlNCaGMydGxaQ0JtYjNJZ1kyRnVibTkwSUdKbElIQnliM1pwWkdWa0xDQmhibVFnZDJVZ2IyNXNlU0IxYzJVZ2RHaGxjMlVnWTI5dmEybGxjeUIwYnlCd2NtOTJhV1JsSUhsdmRTQjNhWFJvSUhSb2IzTmxJSE5sY25acFkyVnpMand2ZEdRK0Nna0pQQzkwY2o0S0NRazhkSEkrQ2drSkNUeDBaRDVHZFc1amRHbHZibUZzYVhSNUlFTnZiMnRwWlhNOEwzUmtQZ29KQ1FrOGRHUStWR2hsYzJVZ1kyOXZhMmxsY3lCaGJHeHZkeUJ2ZFhJZ1UybDBaU0IwYnlCeVpXMWxiV0psY2lCamFHOXBZMlZ6SUhsdmRTQnRZV3RsSUhkb1pXNGdlVzkxSUhWelpTQnZkWElnVTJsMFpTd2djM1ZqYUNCaGN5QnlaVzFsYldKbGNtbHVaeUI1YjNWeUlHeGhibWQxWVdkbElIQnlaV1psY21WdVkyVnpMQ0J5WlcxbGJXSmxjbWx1WnlCNWIzVnlJR3h2WjJsdUlHUmxkR0ZwYkhNZ1lXNWtJSEpsYldWdFltVnlhVzVuSUhSb1pTQmphR0Z1WjJWeklIbHZkU0J0WVd0bElIUnZJRzkwYUdWeUlIQmhjblJ6SUc5bUlHOTFjaUJUYVhSbElIZG9hV05vSUhsdmRTQmpZVzRnWTNWemRHOXRhWHBsSUZSb1pTQndkWEp3YjNObElHOW1JSFJvWlhObElHTnZiMnRwWlhNZ2FYTWdkRzhnY0hKdmRtbGtaU0I1YjNVZ2QybDBhQ0JoSUcxdmNtVWdjR1Z5YzI5dVlXd2daWGh3WlhKcFpXNWpaU0JoYm1RZ2RHOGdZWFp2YVdRZ2VXOTFJR2hoZG1sdVp5QjBieUJ5WlMxbGJuUmxjaUI1YjNWeUlIQnlaV1psY21WdVkyVnpJR1YyWlhKNUlIUnBiV1VnZVc5MUlIWnBjMmwwSUc5MWNpQlRhWFJsUEM5MFpENEtDUWs4TDNSeVBnb0pDVHgwY2o0S0NRa0pQSFJrUGtGdVlXeDVkR2xqYzJGdVpDQlFaWEptYjNKdFlXNWpaU0JEYjI5cmFXVnpQQzkwWkQ0S0NRa0pQSFJrUGxSb1pYTmxJR052YjJ0cFpYTWdZWEpsSUhWelpXUWdkRzhnWTI5c2JHVmpkQ0JwYm1admNtMWhkR2x2YmlCaFltOTFkQ0IwY21GbVptbGpJSFJ2SUc5MWNpQlRhWFJsSUdGdVpDQm9iM2NnZFhObGNuTWdkWE5sSUc5MWNpQlRhWFJsTGlCVWFHVWdhVzVtYjNKdFlYUnBiMjRnWjJGMGFHVnlaV1FnWkc5bGN5QnViM1FnYVdSbGJuUnBabmtnWVc1NUlHbHVaR2wyYVdSMVlXd2dkbWx6YVhSdmNpNGdTWFFnYVc1amJIVmtaWE1nZEdobElHNTFiV0psY2lCdlppQjJhWE5wZEc5eWN5QjBieUJ2ZFhJZ1UybDBaU3dnZEdobElIZGxZbk5wZEdWeklIUm9ZWFFnY21WbVpYSnlaV1FnZEdobGJTQjBieUJ2ZFhJZ1UybDBaU3dnZEdobElIQmhaMlZ6SUhSb1pYa2dkbWx6YVhSbFpDQnZiaUJ2ZFhJZ1UybDBaU3dnZDJoaGRDQjBhVzFsSUc5bUlHUmhlU0IwYUdWNUlIWnBjMmwwWldRZ2IzVnlJRk5wZEdVc0lIZG9aWFJvWlhJZ2RHaGxlU0JvWVhabElIWnBjMmwwWldRZ2IzVnlJRk5wZEdVZ1ltVm1iM0psTENCaGJtUWdiM1JvWlhJZ2MybHRhV3hoY2lCcGJtWnZjbTFoZEdsdmJpNGdWMlVnZFhObElIUm9hWE1nYVc1bWIzSnRZWFJwYjI0Z2RHOGdhR1ZzY0NCdmNHVnlZWFJsSUc5MWNpQlRhWFJsSUcxdmNtVWdaV1ptYVdOcFpXNTBiSGtzSUhSdklHZGhkR2hsY2lCaWNtOWhaQ0JrWlcxdlozSmhjR2hwWXlCcGJtWnZjbTFoZEdsdmJpQmhibVFnZEc4Z2JXOXVhWFJ2Y2lCMGFHVWdiR1YyWld3Z2IyWWdZV04wYVhacGRIa2diMjRnYjNWeUlGTnBkR1V1SUZkbElIVnpaU0JIYjI5bmJHVWdRVzVoYkhsMGFXTnpJR1p2Y2lCMGFHbHpJSEIxY25CdmMyVXVJRWR2YjJkc1pTQkJibUZzZVhScFkzTWdkWE5sY3lCcGRITWdiM2R1SUdOdmIydHBaWE11SUVsMElHbHpJRzl1YkhrZ2RYTmxaQ0IwYnlCcGJYQnliM1psSUdodmR5QnZkWElnVTJsMFpTQjNiM0pyY3k0Z1dXOTFJR05oYmlCbWFXNWtJRzkxZENCdGIzSmxJR2x1Wm05eWJXRjBhVzl1SUdGaWIzVjBJRWR2YjJkc1pTQkJibUZzZVhScFkzTWdZMjl2YTJsbGN5Qm9aWEpsT2lBOFlTQm9jbVZtUFNKb2RIUndjem92TDJSbGRtVnNiM0JsY25NdVoyOXZaMnhsTG1OdmJTOWhibUZzZVhScFkzTXZjbVZ6YjNWeVkyVnpMMk52Ym1ObGNIUnpMMmRoUTI5dVkyVndkSE5EYjI5cmFXVnpJaUIwWVhKblpYUTlJbDlpYkdGdWF5SSthSFIwY0hNNkx5OWtaWFpsYkc5d1pYSnpMbWR2YjJkc1pTNWpiMjB2WVc1aGJIbDBhV056TDNKbGMyOTFjbU5sY3k5amIyNWpaWEIwY3k5bllVTnZibU5sY0hSelEyOXZhMmxsY3p3dllUNGdXVzkxSUdOaGJpQm1hVzVrSUc5MWRDQnRiM0psSUdGaWIzVjBJR2h2ZHlCSGIyOW5iR1VnY0hKdmRHVmpkSE1nZVc5MWNpQmtZWFJoSUdobGNtVTZJSGQzZHk1bmIyOW5iR1V1WTI5dEwyRnVZV3g1ZEdsamN5OXNaV0Z5Ymk5d2NtbDJZV041TG1oMGJXd3VJRmx2ZFNCallXNGdjSEpsZG1WdWRDQjBhR1VnZFhObElHOW1JRWR2YjJkc1pTQkJibUZzZVhScFkzTWdjbVZzWVhScGJtY2dkRzhnZVc5MWNpQjFjMlVnYjJZZ2IzVnlJRk5wZEdVZ1lua2daRzkzYm14dllXUnBibWNnWVc1a0lHbHVjM1JoYkd4cGJtY2dkR2hsSUdKeWIzZHpaWElnY0d4MVoybHVJR0YyWVdsc1lXSnNaU0IyYVdFZ2RHaHBjeUJzYVc1ck9pQThZU0JvY21WbVBTSm9kSFJ3T2k4dmRHOXZiSE11WjI5dloyeGxMbU52YlM5a2JIQmhaMlV2WjJGdmNIUnZkWFEvYUd3OVpXNHRSMElpSUhSaGNtZGxkRDBpWDJKc1lXNXJJajVvZEhSd09pOHZkRzl2YkhNdVoyOXZaMnhsTG1OdmJTOWtiSEJoWjJVdloyRnZjSFJ2ZFhRL2FHdzlaVzR0UjBJOEwyRStQQzkwWkQ0S0NRazhMM1J5UGdvSkNUeDBjajRLQ1FrSlBIUmtQbFJoY21kbGRHVmtJR0Z1WkNCaFpIWmxjblJwYzJsdVp5QmpiMjlyYVdWelBDOTBaRDRLQ1FrSlBIUmtQbFJvWlhObElHTnZiMnRwWlhNZ2RISmhZMnNnZVc5MWNpQmljbTkzYzJsdVp5Qm9ZV0pwZEhNZ2RHOGdaVzVoWW14bElIVnpJSFJ2SUhOb2IzY2dZV1IyWlhKMGFYTnBibWNnZDJocFkyZ2dhWE1nYlc5eVpTQnNhV3RsYkhrZ2RHOGdZbVVnYjJZZ2FXNTBaWEpsYzNRZ2RHOGdlVzkxTGlCVWFHVnpaU0JqYjI5cmFXVnpJSFZ6WlNCcGJtWnZjbTFoZEdsdmJpQmhZbTkxZENCNWIzVnlJR0p5YjNkemFXNW5JR2hwYzNSdmNua2dkRzhnWjNKdmRYQWdlVzkxSUhkcGRHZ2diM1JvWlhJZ2RYTmxjbk1nZDJodklHaGhkbVVnYzJsdGFXeGhjaUJwYm5SbGNtVnpkSE11SUVKaGMyVmtJRzl1SUhSb1lYUWdhVzVtYjNKdFlYUnBiMjRzSUdGdVpDQjNhWFJvSUc5MWNpQndaWEp0YVhOemFXOXVMQ0IwYUdseVpDQndZWEowZVNCaFpIWmxjblJwYzJWeWN5QmpZVzRnY0d4aFkyVWdZMjl2YTJsbGN5QjBieUJsYm1GaWJHVWdkR2hsYlNCMGJ5QnphRzkzSUdGa2RtVnlkSE1nZDJocFkyZ2dkMlVnZEdocGJtc2dkMmxzYkNCaVpTQnlaV3hsZG1GdWRDQjBieUI1YjNWeUlHbHVkR1Z5WlhOMGN5QjNhR2xzWlNCNWIzVWdZWEpsSUc5dUlIUm9hWEprSUhCaGNuUjVJSGRsWW5OcGRHVnpMaUJaYjNVZ1kyRnVJR1JwYzJGaWJHVWdZMjl2YTJsbGN5QjNhR2xqYUNCeVpXMWxiV0psY2lCNWIzVnlJR0p5YjNkemFXNW5JR2hoWW1sMGN5QmhibVFnZEdGeVoyVjBJR0ZrZG1WeWRHbHphVzVuSUdGMElIbHZkU0JpZVNCMmFYTnBkR2x1WnlBOFlTQm9jbVZtUFNKb2RIUndPaTh2ZDNkM0xubHZkWEp2Ym14cGJtVmphRzlwWTJWekxtTnZiUzkxYXk5NWIzVnlMV0ZrTFdOb2IybGpaWE1pSUhSaGNtZGxkRDBpWDJKc1lXNXJJajVvZEhSd09pOHZkM2QzTG5sdmRYSnZibXhwYm1WamFHOXBZMlZ6TG1OdmJTOTFheTk1YjNWeUxXRmtMV05vYjJsalpYTThMMkUrTGlCSlppQjViM1VnWTJodmIzTmxJSFJ2SUhKbGJXOTJaU0IwWVhKblpYUmxaQ0J2Y2lCaFpIWmxjblJwYzJsdVp5QmpiMjlyYVdWekxDQjViM1VnZDJsc2JDQnpkR2xzYkNCelpXVWdZV1IyWlhKMGN5QmlkWFFnZEdobGVTQnRZWGtnYm05MElHSmxJSEpsYkdWMllXNTBJSFJ2SUhsdmRTNGdSWFpsYmlCcFppQjViM1VnWkc4Z1kyaHZiM05sSUhSdklISmxiVzkyWlNCamIyOXJhV1Z6SUdKNUlIUm9aU0JqYjIxd1lXNXBaWE1nYkdsemRHVmtJR0YwSUhSb1pTQmhZbTkyWlNCc2FXNXJMQ0J1YjNRZ1lXeHNJR052YlhCaGJtbGxjeUIwYUdGMElITmxjblpsSUc5dWJHbHVaU0JpWldoaGRtbHZjbUZzSUdGa2RtVnlkR2x6YVc1bklHRnlaU0JwYm1Oc2RXUmxaQ0JwYmlCMGFHbHpJR3hwYzNRc0lHRnVaQ0J6YnlCNWIzVWdiV0Y1SUhOMGFXeHNJSEpsWTJWcGRtVWdjMjl0WlNCamIyOXJhV1Z6SUdGdVpDQjBZV2xzYjNKbFpDQmhaSFpsY25SeklHWnliMjBnWTI5dGNHRnVhV1Z6SUhSb1lYUWdZWEpsSUc1dmRDQnNhWE4wWldRdVBDOTBaRDRLQ1FrOEwzUnlQZ29KQ1R4MGNqNEtDUWtKUEhSa1BsTnZZMmxoYkNCTlpXUnBZU0JEYjI5cmFXVnpQQzkwWkQ0S0NRa0pQSFJrUGxSb1pYTmxJR052YjJ0cFpYTWdZWEpsSUhWelpXUWdkMmhsYmlCNWIzVWdjMmhoY21VZ2FXNW1iM0p0WVhScGIyNGdkWE5wYm1jZ1lTQnpiMk5wWVd3Z2JXVmthV0VnYzJoaGNtbHVaeUJpZFhSMGIyNGdiM0lnSm14a2NYVnZPMnhwYTJVbWNtUnhkVzg3SUdKMWRIUnZiaUJ2YmlCdmRYSWdVMmwwWlNCdmNpQjViM1VnYkdsdWF5QjViM1Z5SUdGalkyOTFiblFnYjNJZ1pXNW5ZV2RsSUhkcGRHZ2diM1Z5SUdOdmJuUmxiblFnYjI0Z2IzSWdkR2h5YjNWbmFDQmhJSE52WTJsaGJDQnVaWFIzYjNKcmFXNW5JSGRsWW5OcGRHVWdjM1ZqYUNCaGN5QkdZV05sWW05dmF5d2dWSGRwZEhSbGNpQnZjaUJIYjI5bmJHVXJMaUJVYUdVZ2MyOWphV0ZzSUc1bGRIZHZjbXNnZDJsc2JDQnlaV052Y21RZ2RHaGhkQ0I1YjNVZ2FHRjJaU0JrYjI1bElIUm9hWE11UEM5MFpENEtDUWs4TDNSeVBnb0pQQzkwWW05a2VUNEtQQzkwWVdKc1pUNEtQR0p5SUM4K0NqeHpkSEp2Ym1jK1JHbHpZV0pzYVc1bklHTnZiMnRwWlhNOEwzTjBjbTl1Wno0OFluSWdMejRLUEdKeUlDOCtDbGx2ZFNCallXNGdkSGx3YVdOaGJHeDVJSEpsYlc5MlpTQnZjaUJ5WldwbFkzUWdZMjl2YTJsbGN5QjJhV0VnZVc5MWNpQmljbTkzYzJWeUlITmxkSFJwYm1kekxpQkpiaUJ2Y21SbGNpQjBieUJrYnlCMGFHbHpMQ0JtYjJ4c2IzY2dkR2hsSUdsdWMzUnlkV04wYVc5dWN5QndjbTkyYVdSbFpDQmllU0I1YjNWeUlHSnliM2R6WlhJZ0tIVnpkV0ZzYkhrZ2JHOWpZWFJsWkNCM2FYUm9hVzRnZEdobElDWnNaSEYxYnp0elpYUjBhVzVuY3l3bWNtUnhkVzg3SUNac1pIRjFienRvWld4d0puSmtjWFZ2T3lBbWJHUnhkVzg3ZEc5dmJITW1jbVJ4ZFc4N0lHOXlJQ1pzWkhGMWJ6dGxaR2wwSm5Ka2NYVnZPeUJtWVdOcGJHbDBlU2t1SUUxaGJua2dZbkp2ZDNObGNuTWdZWEpsSUhObGRDQjBieUJoWTJObGNIUWdZMjl2YTJsbGN5QjFiblJwYkNCNWIzVWdZMmhoYm1kbElIbHZkWElnYzJWMGRHbHVaM011Sm01aWMzQTdQR0p5SUM4K0NrbG1JSGx2ZFNCa2J5QnViM1FnWVdOalpYQjBJRzkxY2lCamIyOXJhV1Z6TENCNWIzVWdiV0Y1SUdWNGNHVnlhV1Z1WTJVZ2MyOXRaU0JwYm1OdmJuWmxibWxsYm1ObElHbHVJSGx2ZFhJZ2RYTmxJRzltSUc5MWNpQlRhWFJsTGlCR2IzSWdaWGhoYlhCc1pTd2dkMlVnYldGNUlHNXZkQ0JpWlNCaFlteGxJSFJ2SUhKbFkyOW5ibWw2WlNCNWIzVnlJR052YlhCMWRHVnlJRzl5SUcxdlltbHNaU0JrWlhacFkyVWdZVzVrSUhsdmRTQnRZWGtnYm1WbFpDQjBieUJzYjJjZ2FXNGdaWFpsY25rZ2RHbHRaU0I1YjNVZ2RtbHphWFFnYjNWeUlGTnBkR1V1UEdKeUlDOCtDanhpY2lBdlBnbzhjM1J5YjI1blBqUXVJRUZFVmtWU1ZFbFRTVTVIUEM5emRISnZibWMrUEdKeUlDOCtDanhpY2lBdlBncFhaU0J0WVhrZ2RYTmxJRzkwYUdWeUlHTnZiWEJoYm1sbGN5QjBieUJ6WlhKMlpTQjBhR2x5WkMxd1lYSjBlU0JoWkhabGNuUnBjMlZ0Wlc1MGN5QjNhR1Z1SUhsdmRTQjJhWE5wZENCaGJtUWdkWE5sSUhSb1pTQlRhWFJsTGlCVWFHVnpaU0JqYjIxd1lXNXBaWE1nYldGNUlHTnZiR3hsWTNRZ1lXNWtJSFZ6WlNCamJHbGpheUJ6ZEhKbFlXMGdhVzVtYjNKdFlYUnBiMjRzSUdKeWIzZHpaWElnZEhsd1pTd2dkR2x0WlNCaGJtUWdaR0YwWlN3Z2MzVmlhbVZqZENCdlppQmhaSFpsY25ScGMyVnRaVzUwY3lCamJHbGphMlZrSUc5eUlITmpjbTlzYkdWa0lHOTJaWElnWkhWeWFXNW5JSGx2ZFhJZ2RtbHphWFJ6SUhSdklIUm9aU0JUYVhSbElHRnVaQ0J2ZEdobGNpQjNaV0p6YVhSbGN5QnBiaUJ2Y21SbGNpQjBieUJ3Y205MmFXUmxJR0ZrZG1WeWRHbHpaVzFsYm5SeklHRmliM1YwSUdkdmIyUnpJR0Z1WkNCelpYSjJhV05sY3lCc2FXdGxiSGtnZEc4Z1ltVWdiMllnYVc1MFpYSmxjM1FnZEc4Z2VXOTFMaUJVYUdWelpTQmpiMjF3WVc1cFpYTWdkSGx3YVdOaGJHeDVJSFZ6WlNCMGNtRmphMmx1WnlCMFpXTm9ibTlzYjJkcFpYTWdkRzhnWTI5c2JHVmpkQ0IwYUdseklHbHVabTl5YldGMGFXOXVMaUJQZEdobGNpQmpiMjF3WVc1cFpYTW1Jek01T3lCMWMyVWdiMllnZEdobGFYSWdkSEpoWTJ0cGJtY2dkR1ZqYUc1dmJHOW5hV1Z6SUdseklITjFZbXBsWTNRZ2RHOGdkR2hsYVhJZ2IzZHVJSEJ5YVhaaFkza2djRzlzYVdOcFpYTXVQR0p5SUM4K0NqeGljaUF2UGdvOGMzUnliMjVuUGpVdUlGVlRTVTVISUZsUFZWSWdVRVZTVTA5T1FVd2dSRUZVUVR3dmMzUnliMjVuUGp4aWNpQXZQZ284WW5JZ0x6NEtWMlVnYldGNUlIVnpaU0I1YjNWeUlIQmxjbk52Ym1Gc0lHUmhkR0VnWVhNZ1ptOXNiRzkzY3pvS1BIVnNQZ29KUEd4cFBuUnZJRzl3WlhKaGRHVXNJRzFoYVc1MFlXbHVMQ0JoYm1RZ2FXMXdjbTkyWlNCdmRYSWdVMmwwWlN3Z2NISnZaSFZqZEhNc0lHRnVaQ0J6WlhKMmFXTmxjenM4TDJ4cFBnb0pQR3hwUG5SdklHMWhibUZuWlNCNWIzVnlJR0ZqWTI5MWJuUXNJR2x1WTJ4MVpHbHVaeUIwYnlCamIyMXRkVzVwWTJGMFpTQjNhWFJvSUhsdmRTQnlaV2RoY21ScGJtY2dlVzkxY2lCaFkyTnZkVzUwTENCcFppQjViM1VnYUdGMlpTQmhiaUJoWTJOdmRXNTBJRzl1SUc5MWNpQlRhWFJsT3p3dmJHaytDZ2s4YkdrK2RHOGdiM0JsY21GMFpTQmhibVFnWVdSdGFXNXBjM1JsY2lCdmRYSWdjbVYzWVhKa2N5QndjbTluY21GdElHRnVaQ0J2ZEdobGNpQndjbTl0YjNScGIyNXpJSGx2ZFNCd1lYSjBhV05wY0dGMFpTQnBiaUJ2YmlCdmRYSWdVMmwwWlRzOEwyeHBQZ29KUEd4cFBuUnZJSEpsYzNCdmJtUWdkRzhnZVc5MWNpQmpiMjF0Wlc1MGN5QmhibVFnY1hWbGMzUnBiMjV6SUdGdVpDQjBieUJ3Y205MmFXUmxJR04xYzNSdmJXVnlJSE5sY25acFkyVTdQQzlzYVQ0S0NUeHNhVDUwYnlCelpXNWtJR2x1Wm05eWJXRjBhVzl1SUdsdVkyeDFaR2x1WnlCMFpXTm9ibWxqWVd3Z2JtOTBhV05sY3l3Z2RYQmtZWFJsY3l3Z2MyVmpkWEpwZEhrZ1lXeGxjblJ6TENCaGJtUWdjM1Z3Y0c5eWRDQmhibVFnWVdSdGFXNXBjM1J5WVhScGRtVWdiV1Z6YzJGblpYTTdQQzlzYVQ0S0NUeHNhVDUzYVhSb0lIbHZkWElnWTI5dWMyVnVkQ3dnZEc4Z2MyVnVaQ0I1YjNVZ2JXRnlhMlYwYVc1bklHVXRiV0ZwYkhNZ1lXSnZkWFFnZFhCamIyMXBibWNnY0hKdmJXOTBhVzl1Y3l3Z1lXNWtJRzkwYUdWeUlHNWxkM01zSUdsdVkyeDFaR2x1WnlCcGJtWnZjbTFoZEdsdmJpQmhZbTkxZENCd2NtOWtkV04wY3lCaGJtUWdjMlZ5ZG1salpYTWdiMlptWlhKbFpDQmllU0IxY3lCaGJtUWdiM1Z5SUdGbVptbHNhV0YwWlhNdUlGbHZkU0J0WVhrZ2IzQjBMVzkxZENCdlppQnlaV05sYVhacGJtY2djM1ZqYUNCcGJtWnZjbTFoZEdsdmJpQmhkQ0JoYm5rZ2RHbHRaVG9nYzNWamFDQnRZWEpyWlhScGJtY2daVzFoYVd4eklIUmxiR3dnZVc5MUlHaHZkeUIwYnlBbWJHUnhkVzg3YjNCMExXOTFkQzRtY21SeGRXODdJRkJzWldGelpTQnViM1JsTENCbGRtVnVJR2xtSUhsdmRTQnZjSFFnYjNWMElHOW1JSEpsWTJWcGRtbHVaeUJ0WVhKclpYUnBibWNnWlcxaGFXeHpMQ0IzWlNCdFlYa2djM1JwYkd3Z2MyVnVaQ0I1YjNVZ2JtOXVMVzFoY210bGRHbHVaeUJsYldGcGJITXVJRTV2YmkxdFlYSnJaWFJwYm1jZ1pXMWhhV3h6SUdsdVkyeDFaR1VnWlcxaGFXeHpJR0ZpYjNWMElIbHZkWElnWVdOamIzVnVkQ0IzYVhSb0lIVnpJQ2hwWmlCNWIzVWdhR0YyWlNCdmJtVXBJR0Z1WkNCdmRYSWdZblZ6YVc1bGMzTWdaR1ZoYkdsdVozTWdkMmwwYUNCNWIzVTdJQ1p1WW5Od096d3ZiR2srQ2drOGJHaytZWE1nZDJVZ1ltVnNhV1YyWlNCdVpXTmxjM05oY25rZ2IzSWdZWEJ3Y205d2NtbGhkR1VnS0dFcElIUnZJR052YlhCc2VTQjNhWFJvSUdGd2NHeHBZMkZpYkdVZ2JHRjNjenNnS0dJcElIUnZJR052YlhCc2VTQjNhWFJvSUd4aGQyWjFiQ0J5WlhGMVpYTjBjeUJoYm1RZ2JHVm5ZV3dnY0hKdlkyVnpjeXdnYVc1amJIVmthVzVuSUhSdklISmxjM0J2Ym1RZ2RHOGdjbVZ4ZFdWemRITWdabkp2YlNCd2RXSnNhV01nWVc1a0lHZHZkbVZ5Ym0xbGJuUWdZWFYwYUc5eWFYUnBaWE03SUNoaktTQjBieUJsYm1admNtTmxJRzkxY2lCUWIyeHBZM2s3SUdGdVpDQW9aQ2tnZEc4Z2NISnZkR1ZqZENCdmRYSWdjbWxuYUhSekxDQndjbWwyWVdONUxDQnpZV1psZEhrZ2IzSWdjSEp2Y0dWeWRIa3NJR0Z1WkM5dmNpQjBhR0YwSUc5bUlIbHZkU0J2Y2lCdmRHaGxjbk03UEM5c2FUNEtDVHhzYVQ1bWIzSWdZVzVoYkhsemFYTWdZVzVrSUhOMGRXUjVJSE5sY25acFkyVnpPeUJoYm1ROEwyeHBQZ29KUEd4cFBtRnpJR1JsYzJOeWFXSmxaQ0JwYmlCMGFHVWdKbXhrY1hWdk8xTm9ZWEpwYm1jZ2IyWWdlVzkxY2lCUVpYSnpiMjVoYkNCRVlYUmhKbkprY1hWdk95QnpaV04wYVc5dUlHSmxiRzkzTGp3dmJHaytDand2ZFd3K0NqeHpkSEp2Ym1jK05pNGdVMGhCVWtsT1J5QlpUMVZTSUZCRlVsTlBUa0ZNSUVSQlZFRThMM04wY205dVp6NDhZbklnTHo0S1BHSnlJQzgrQ2xkbElHMWhlU0J6YUdGeVpTQjViM1Z5SUhCbGNuTnZibUZzSUdSaGRHRWdZWE1nWm05c2JHOTNjem9LUEhWc1Bnb0pQR3hwUGxSb2FYSmtJRkJoY25ScFpYTWdSR1Z6YVdkdVlYUmxaQ0JpZVNCWmIzVXVJRmRsSUcxaGVTQnphR0Z5WlNCNWIzVnlJSEJsY25OdmJtRnNJR1JoZEdFZ2QybDBhQ0IwYUdseVpDQndZWEowYVdWeklIZG9aWEpsSUhsdmRTQm9ZWFpsSUhCeWIzWnBaR1ZrSUhsdmRYSWdZMjl1YzJWdWRDQjBieUJrYnlCemJ5NDhMMnhwUGdvSlBHeHBQazkxY2lCVWFHbHlaQ0JRWVhKMGVTQlRaWEoyYVdObElGQnliM1pwWkdWeWN5NGdWMlVnYldGNUlITm9ZWEpsSUhsdmRYSWdjR1Z5YzI5dVlXd2daR0YwWVNCM2FYUm9JRzkxY2lCMGFHbHlaQ0J3WVhKMGVTQnpaWEoyYVdObElIQnliM1pwWkdWeWN5QjNhRzhnY0hKdmRtbGtaU0J6WlhKMmFXTmxjeUJ6ZFdOb0lHRnpJR1JoZEdFZ1lXNWhiSGx6YVhNc0lIQmhlVzFsYm5RZ2NISnZZMlZ6YzJsdVp5d2dhVzVtYjNKdFlYUnBiMjRnZEdWamFHNXZiRzluZVNCaGJtUWdjbVZzWVhSbFpDQnBibVp5WVhOMGNuVmpkSFZ5WlNCd2NtOTJhWE5wYjI0c0lHTjFjM1J2YldWeUlITmxjblpwWTJVc0lHVnRZV2xzSUdSbGJHbDJaWEo1TENCaGRXUnBkR2x1WnlCaGJtUWdiM1JvWlhJZ2MybHRhV3hoY2lCelpYSjJhV05sY3k0bWJtSnpjRHM4TDJ4cFBnbzhMM1ZzUGdvOGMzUnliMjVuUGpjdUlGUklTVkpFSUZCQlVsUlpJRk5KVkVWVFBDOXpkSEp2Ym1jK1BHSnlJQzgrQ2p4aWNpQXZQZ3BQZFhJZ1UybDBaU0J0WVhrZ1kyOXVkR0ZwYmlCc2FXNXJjeUIwYnlCMGFHbHlaQ0J3WVhKMGVTQjNaV0p6YVhSbGN5QmhibVFnWm1WaGRIVnlaWE11SUZSb2FYTWdVRzlzYVdONUlHUnZaWE1nYm05MElHTnZkbVZ5SUhSb1pTQndjbWwyWVdONUlIQnlZV04wYVdObGN5QnZaaUJ6ZFdOb0lIUm9hWEprSUhCaGNuUnBaWE11SUZSb1pYTmxJSFJvYVhKa0lIQmhjblJwWlhNZ2FHRjJaU0IwYUdWcGNpQnZkMjRnY0hKcGRtRmplU0J3YjJ4cFkybGxjeUJoYm1RZ2QyVWdaRzhnYm05MElHRmpZMlZ3ZENCaGJua2djbVZ6Y0c5dWMybGlhV3hwZEhrZ2IzSWdiR2xoWW1sc2FYUjVJR1p2Y2lCMGFHVnBjaUIzWldKemFYUmxjeXdnWm1WaGRIVnlaWE1nYjNJZ2NHOXNhV05wWlhNdUlGQnNaV0Z6WlNCeVpXRmtJSFJvWldseUlIQnlhWFpoWTNrZ2NHOXNhV05wWlhNZ1ltVm1iM0psSUhsdmRTQnpkV0p0YVhRZ1lXNTVJR1JoZEdFZ2RHOGdkR2hsYlM0OFluSWdMejRLUEdKeUlDOCtDanh6ZEhKdmJtYytWVk5GVWlCSFJVNUZVa0ZVUlVRZ1EwOU9WRVZPVkR3dmMzUnliMjVuUGp4aWNpQXZQZ284WW5JZ0x6NEtXVzkxSUcxaGVTQnphR0Z5WlNCd1pYSnpiMjVoYkNCa1lYUmhJSGRwZEdnZ2RYTWdkMmhsYmlCNWIzVWdjM1ZpYldsMElIVnpaWElnWjJWdVpYSmhkR1ZrSUdOdmJuUmxiblFnZEc4Z2IzVnlJRk5wZEdVc0lHbHVZMngxWkdsdVp5QjJhV0VnYjNWeUlISmxkMkZ5WkhNZ2NISnZaM0poYlN3Z1ptOXlkVzF6TENCdFpYTnpZV2RsSUdKdllYSmtjeUJoYm1RZ1lteHZaM01nYjI0Z2IzVnlJRk5wZEdVdUlGQnNaV0Z6WlNCdWIzUmxJSFJvWVhRZ1lXNTVJR2x1Wm05eWJXRjBhVzl1SUhsdmRTQndiM04wSUc5eUlHUnBjMk5zYjNObElHOXVJRzkxY2lCVGFYUmxJSGRwYkd3Z1ltVmpiMjFsSUhCMVlteHBZeUJwYm1admNtMWhkR2x2Yml3Z1lXNWtJSGRwYkd3Z1ltVWdZWFpoYVd4aFlteGxJSFJ2SUc5MGFHVnlJSFZ6WlhKeklHOW1JRzkxY2lCVGFYUmxJR0Z1WkNCMGJ5QjBhR1VnWjJWdVpYSmhiQ0J3ZFdKc2FXTXVJRmRsSUhWeVoyVWdlVzkxSUhSdklHSmxJSFpsY25rZ1kyRnlaV1oxYkNCM2FHVnVJR1JsWTJsa2FXNW5JSFJ2SUdScGMyTnNiM05sSUhsdmRYSWdjR1Z5YzI5dVlXd2daR0YwWVN3Z2IzSWdZVzU1SUc5MGFHVnlJR2x1Wm05eWJXRjBhVzl1TENCdmJpQnZkWElnVTJsMFpTNGdVM1ZqYUNCd1pYSnpiMjVoYkNCa1lYUmhJR0Z1WkNCdmRHaGxjaUJwYm1admNtMWhkR2x2YmlCM2FXeHNJRzV2ZENCaVpTQndjbWwyWVhSbElHOXlJR052Ym1acFpHVnVkR2xoYkNCdmJtTmxJR2wwSUdseklIQjFZbXhwYzJobFpDQnZiaUJ2ZFhJZ1UybDBaUzQ4WW5JZ0x6NEtQR0p5SUM4K0NrbG1JSGx2ZFNCd2NtOTJhV1JsSUdabFpXUmlZV05ySUhSdklIVnpMQ0IzWlNCdFlYa2dkWE5sSUdGdVpDQmthWE5qYkc5elpTQnpkV05vSUdabFpXUmlZV05ySUc5dUlHOTFjaUJUYVhSbElFbG1JSGx2ZFNCb1lYWmxJSEJ5YjNacFpHVmtJSGx2ZFhJZ1kyOXVjMlZ1ZENCMGJ5QmtieUJ6Ynl3Z2QyVWdiV0Y1SUhCdmMzUWdlVzkxY2lCbWFYSnpkQ0JoYm1RZ2JHRnpkQ0J1WVcxbElHRnNiMjVuSUhkcGRHZ2dlVzkxY2lCbVpXVmtZbUZqYXlCdmJpQnZkWElnVTJsMFpTNGdWMlVnZDJsc2JDQmpiMnhzWldOMElHRnVlU0JwYm1admNtMWhkR2x2YmlCamIyNTBZV2x1WldRZ2FXNGdjM1ZqYUNCbVpXVmtZbUZqYXlCaGJtUWdkMmxzYkNCMGNtVmhkQ0IwYUdVZ2NHVnljMjl1WVd3Z1pHRjBZU0JwYmlCcGRDQnBiaUJoWTJOdmNtUmhibU5sSUhkcGRHZ2dkR2hwY3lCUWIyeHBZM2t1UEdKeUlDOCtDanhpY2lBdlBnbzhjM1J5YjI1blBqZ3VJRWxPVkVWU1RrRlVTVTlPUVV3Z1JFRlVRU0JVVWtGT1UwWkZVand2YzNSeWIyNW5QanhpY2lBdlBnbzhZbklnTHo0S1dXOTFjaUJwYm1admNtMWhkR2x2Yml3Z2FXNWpiSFZrYVc1bklIQmxjbk52Ym1Gc0lHUmhkR0VnZEdoaGRDQjNaU0JqYjJ4c1pXTjBJR1p5YjIwZ2VXOTFMQ0J0WVhrZ1ltVWdkSEpoYm5ObVpYSnlaV1FnZEc4c0lITjBiM0psWkNCaGRDQmhibVFnY0hKdlkyVnpjMlZrSUdKNUlIVnpJRzkxZEhOcFpHVWdkR2hsSUdOdmRXNTBjbmtnYVc0Z2QyaHBZMmdnZVc5MUlISmxjMmxrWlN3Z2QyaGxjbVVnWkdGMFlTQndjbTkwWldOMGFXOXVJR0Z1WkNCd2NtbDJZV041SUhKbFozVnNZWFJwYjI1eklHMWhlU0J1YjNRZ2IyWm1aWElnZEdobElITmhiV1VnYkdWMlpXd2diMllnY0hKdmRHVmpkR2x2YmlCaGN5QnBiaUJ2ZEdobGNpQndZWEowY3lCdlppQjBhR1VnZDI5eWJHUXVJRUo1SUdGalkyVndkR2x1WnlCMGFHbHpJRkJ2YkdsamVTd2dlVzkxSUdGbmNtVmxJSFJ2SUhSb2FYTWdkSEpoYm5ObVpYSXNJSE4wYjNKcGJtY2diM0lnY0hKdlkyVnpjMmx1Wnk0Z1YyVWdkMmxzYkNCMFlXdGxJR0ZzYkNCemRHVndjeUJ5WldGemIyNWhZbXg1SUc1bFkyVnpjMkZ5ZVNCMGJ5Qmxibk4xY21VZ2RHaGhkQ0I1YjNWeUlHUmhkR0VnYVhNZ2RISmxZWFJsWkNCelpXTjFjbVZzZVNCaGJtUWdhVzRnWVdOamIzSmtZVzVqWlNCM2FYUm9JSFJvYVhNZ1VHOXNhV041TGp4aWNpQXZQZ284WW5JZ0x6NEtQSE4wY205dVp6NDVMaUJUUlVOVlVrbFVXVHd2YzNSeWIyNW5QanhpY2lBdlBnbzhZbklnTHo0S1YyVWdjMlZsYXlCMGJ5QjFjMlVnY21WaGMyOXVZV0pzWlNCdmNtZGhibWw2WVhScGIyNWhiQ3dnZEdWamFHNXBZMkZzSUdGdVpDQmhaRzFwYm1semRISmhkR2wyWlNCdFpXRnpkWEpsY3lCMGJ5QndjbTkwWldOMElIQmxjbk52Ym1Gc0lHUmhkR0VnZDJsMGFHbHVJRzkxY2lCdmNtZGhibWw2WVhScGIyNHVJRlZ1Wm05eWRIVnVZWFJsYkhrc0lHNXZJSFJ5WVc1emJXbHpjMmx2YmlCdmNpQnpkRzl5WVdkbElITjVjM1JsYlNCallXNGdZbVVnWjNWaGNtRnVkR1ZsWkNCMGJ5QmlaU0JqYjIxd2JHVjBaV3g1SUhObFkzVnlaU3dnWVc1a0lIUnlZVzV6YldsemMybHZiaUJ2WmlCcGJtWnZjbTFoZEdsdmJpQjJhV0VnZEdobElHbHVkR1Z5Ym1WMElHbHpJRzV2ZENCamIyMXdiR1YwWld4NUlITmxZM1Z5WlM0Z1NXWWdlVzkxSUdoaGRtVWdjbVZoYzI5dUlIUnZJR0psYkdsbGRtVWdkR2hoZENCNWIzVnlJR2x1ZEdWeVlXTjBhVzl1SUhkcGRHZ2dkWE1nYVhNZ2JtOGdiRzl1WjJWeUlITmxZM1Z5WlNBb1ptOXlJR1Y0WVcxd2JHVXNJR2xtSUhsdmRTQm1aV1ZzSUhSb1lYUWdkR2hsSUhObFkzVnlhWFI1SUc5bUlHRnVlU0JoWTJOdmRXNTBJSGx2ZFNCdGFXZG9kQ0JvWVhabElIZHBkR2dnZFhNZ2FHRnpJR0psWlc0Z1kyOXRjSEp2YldselpXUXBMQ0J3YkdWaGMyVWdhVzF0WldScFlYUmxiSGtnYm05MGFXWjVJSFZ6SUc5bUlIUm9aU0J3Y205aWJHVnRJR0o1SUdOdmJuUmhZM1JwYm1jZ2RYTXVQR0p5SUM4K0NqeGljaUF2UGdvOGMzUnliMjVuUGpFd0xpQlNSVlJGVGxSSlQwNDhMM04wY205dVp6NDhZbklnTHo0S1BHSnlJQzgrQ2xkbElIZHBiR3dnYjI1c2VTQnlaWFJoYVc0Z2VXOTFjaUJ3WlhKemIyNWhiQ0JrWVhSaElHWnZjaUF6TUNCa1lYbHpJSFZ1YkdWemN5QmhJR3h2Ym1kbGNpQnlaWFJsYm5ScGIyNGdjR1Z5YVc5a0lHbHpJSEpsY1hWcGNtVmtJRzl5SUhCbGNtMXBkSFJsWkNCaWVTQnNZWGNnS0dadmNpQmxlR0Z0Y0d4bElHWnZjaUJ5WldkMWJHRjBiM0o1SUhCMWNuQnZjMlZ6S1M0OFluSWdMejRLUEdKeUlDOCtDazlTUEdKeUlDOCtDanhpY2lBdlBncFhaU0IzYVd4c0lHOXViSGtnY21WMFlXbHVJSGx2ZFhJZ2NHVnljMjl1WVd3Z1pHRjBZU0JoY3lCc2IyNW5JSEpsWVhOdmJtRmliSGtnY21WeGRXbHlaV1FnWm05eUlIbHZkU0IwYnlCMWMyVWdkR2hsSUZOcGRHVWdkVzUwYVd3Z2VXOTFJR05zYjNObElIbHZkWElnWVdOamIzVnVkQzlqWVc1alpXd2dlVzkxY2lCemRXSnpZM0pwY0hScGIyNHNJSFZ1YkdWemN5QmhJR3h2Ym1kbGNpQnlaWFJsYm5ScGIyNGdjR1Z5YVc5a0lHbHpJSEpsY1hWcGNtVmtJRzl5SUhCbGNtMXBkSFJsWkNCaWVTQnNZWGNnS0dadmNpQmxlR0Z0Y0d4bElHWnZjaUJ5WldkMWJHRjBiM0o1SUhCMWNuQnZjMlZ6S1M0OFluSWdMejRLUEdKeUlDOCtDanh6ZEhKdmJtYytNVEV1SUU5VlVpQlFUMHhKUTFrZ1QwNGdRMGhKVEVSU1JVNDhMM04wY205dVp6NDhZbklnTHo0S1BHSnlJQzgrQ2s5MWNpQlRhWFJsSUdsekwyRnlaU0J1YjNRZ1pHbHlaV04wWldRZ2RHOGdZMmhwYkdSeVpXNGdkVzVrWlhJZ01UWXVJRWxtSUdFZ2NHRnlaVzUwSUc5eUlHZDFZWEprYVdGdUlHSmxZMjl0WlhNZ1lYZGhjbVVnZEdoaGRDQm9hWE1nYjNJZ2FHVnlJR05vYVd4a0lHaGhjeUJ3Y205MmFXUmxaQ0IxY3lCM2FYUm9JR2x1Wm05eWJXRjBhVzl1SUhkcGRHaHZkWFFnZEdobGFYSWdZMjl1YzJWdWRDd2dhR1VnYjNJZ2MyaGxJSE5vYjNWc1pDQmpiMjUwWVdOMElIVnpMaUJYWlNCM2FXeHNJR1JsYkdWMFpTQnpkV05vSUdsdVptOXliV0YwYVc5dUlHWnliMjBnYjNWeUlHWnBiR1Z6SUdGeklITnZiMjRnWVhNZ2NtVmhjMjl1WVdKc2VTQndjbUZqZEdsallXSnNaUzQ4WW5JZ0x6NEtQR0p5SUM4K0NqeHpkSEp2Ym1jK01USXVJRmxQVlZJZ1VrbEhTRlJUUEM5emRISnZibWMrQ2dvOGRXdytDZ2s4YkdrK1BITjBjbTl1Wno1UGNIUXRiM1YwUEM5emRISnZibWMrTGlCWmIzVWdiV0Y1SUdOdmJuUmhZM1FnZFhNZ1lXNTVkR2x0WlNCMGJ5QnZjSFF0YjNWMElHOW1PaUFvYVNrZ1pHbHlaV04wSUcxaGNtdGxkR2x1WnlCamIyMXRkVzVwWTJGMGFXOXVjenNnS0dscEtTQmhkWFJ2YldGMFpXUWdaR1ZqYVhOcGIyNHRiV0ZyYVc1bklHRnVaQzl2Y2lCd2NtOW1hV3hwYm1jN0lDaHBhV2twSUc5MWNpQmpiMnhzWldOMGFXOXVJRzltSUhObGJuTnBkR2wyWlNCd1pYSnpiMjVoYkNCa1lYUmhPeUFvYVhZcElHRnVlU0J1WlhjZ2NISnZZMlZ6YzJsdVp5QnZaaUI1YjNWeUlIQmxjbk52Ym1Gc0lHUmhkR0VnZEdoaGRDQjNaU0J0WVhrZ1kyRnljbmtnYjNWMElHSmxlVzl1WkNCMGFHVWdiM0pwWjJsdVlXd2djSFZ5Y0c5elpUc2diM0lnS0hZcElIUm9aU0IwY21GdWMyWmxjaUJ2WmlCNWIzVnlJSEJsY25OdmJtRnNJR1JoZEdFZ2IzVjBjMmxrWlNCMGFHVWdSVVZCTGlCUWJHVmhjMlVnYm05MFpTQjBhR0YwSUhsdmRYSWdkWE5sSUc5bUlITnZiV1VnYjJZZ2RHaGxJRk5wZEdVZ2JXRjVJR0psSUdsdVpXWm1aV04wYVhabElIVndiMjRnYjNCMExXOTFkQzRtYm1KemNEczhMMnhwUGdvSlBHeHBQanh6ZEhKdmJtYytRV05qWlhOelBDOXpkSEp2Ym1jK0xpQlpiM1VnYldGNUlHRmpZMlZ6Y3lCMGFHVWdhVzVtYjNKdFlYUnBiMjRnZDJVZ2FHOXNaQ0JoWW05MWRDQjViM1VnWVhRZ1lXNTVJSFJwYldVZ2RtbGhJSGx2ZFhJZ2NISnZabWxzWlM5aFkyTnZkVzUwSUc5eUlHSjVJR052Ym5SaFkzUnBibWNnZFhNZ1pHbHlaV04wYkhrdUptNWljM0E3UEM5c2FUNEtDVHhzYVQ0OGMzUnliMjVuUGtGdFpXNWtQQzl6ZEhKdmJtYytMaUJaYjNVZ1kyRnVJR0ZzYzI4Z1kyOXVkR0ZqZENCMWN5QjBieUIxY0dSaGRHVWdiM0lnWTI5eWNtVmpkQ0JoYm5rZ2FXNWhZMk4xY21GamFXVnpJR2x1SUhsdmRYSWdjR1Z5YzI5dVlXd2daR0YwWVM0OEwyeHBQZ29KUEd4cFBqeHpkSEp2Ym1jK1RXOTJaVHd2YzNSeWIyNW5QaTRnV1c5MWNpQndaWEp6YjI1aGJDQmtZWFJoSUdseklIQnZjblJoWW14bElDWnVaR0Z6YURzZ2FTNWxMaUI1YjNVZ2RHOGdhR0YyWlNCMGFHVWdabXhsZUdsaWFXeHBkSGtnZEc4Z2JXOTJaU0I1YjNWeUlHUmhkR0VnZEc4Z2IzUm9aWElnYzJWeWRtbGpaU0J3Y205MmFXUmxjbk1nWVhNZ2VXOTFJSGRwYzJndUptNWljM0E3UEM5c2FUNEtDVHhzYVQ0OGMzUnliMjVuUGtWeVlYTmxJR0Z1WkNCbWIzSm5aWFE4TDNOMGNtOXVaejR1SUVsdUlHTmxjblJoYVc0Z2MybDBkV0YwYVc5dWN5d2dabTl5SUdWNFlXMXdiR1VnZDJobGJpQjBhR1VnYVc1bWIzSnRZWFJwYjI0Z2QyVWdhRzlzWkNCaFltOTFkQ0I1YjNVZ2FYTWdibThnYkc5dVoyVnlJSEpsYkdWMllXNTBJRzl5SUdseklHbHVZMjl5Y21WamRDd2dlVzkxSUdOaGJpQnlaWEYxWlhOMElIUm9ZWFFnZDJVZ1pYSmhjMlVnZVc5MWNpQmtZWFJoTGladVluTndPend2YkdrK0Nqd3ZkV3crQ2tsbUlIbHZkU0IzYVhOb0lIUnZJR1Y0WlhKamFYTmxJR0Z1ZVNCdlppQjBhR1Z6WlNCeWFXZG9kSE1zSUhCc1pXRnpaU0JqYjI1MFlXTjBJSFZ6TGlCSmJpQjViM1Z5SUhKbGNYVmxjM1FzSUhCc1pXRnpaU0J0WVd0bElHTnNaV0Z5T2lBb2FTa2dQSE4wY205dVp6NTNhR0YwSUR3dmMzUnliMjVuUG5CbGNuTnZibUZzSUdSaGRHRWdhWE1nWTI5dVkyVnlibVZrT3lCaGJtUWdLR2xwS1NBOGMzUnliMjVuUG5kb2FXTm9JRzltSUhSb1pTQmhZbTkyWlNCeWFXZG9kSE04TDNOMGNtOXVaejRnZVc5MUlIZHZkV3hrSUd4cGEyVWdkRzhnWlc1bWIzSmpaUzRnUm05eUlIbHZkWElnY0hKdmRHVmpkR2x2Yml3Z2QyVWdiV0Y1SUc5dWJIa2dhVzF3YkdWdFpXNTBJSEpsY1hWbGMzUnpJSGRwZEdnZ2NtVnpjR1ZqZENCMGJ5QjBhR1VnY0dWeWMyOXVZV3dnWkdGMFlTQmhjM052WTJsaGRHVmtJSGRwZEdnZ2RHaGxJSEJoY25ScFkzVnNZWElnWlcxaGFXd2dZV1JrY21WemN5QjBhR0YwSUhsdmRTQjFjMlVnZEc4Z2MyVnVaQ0IxY3lCNWIzVnlJSEpsY1hWbGMzUXNJR0Z1WkNCM1pTQnRZWGtnYm1WbFpDQjBieUIyWlhKcFpua2dlVzkxY2lCcFpHVnVkR2wwZVNCaVpXWnZjbVVnYVcxd2JHVnRaVzUwYVc1bklIbHZkWElnY21WeGRXVnpkQzRnVjJVZ2QybHNiQ0IwY25rZ2RHOGdZMjl0Y0d4NUlIZHBkR2dnZVc5MWNpQnlaWEYxWlhOMElHRnpJSE52YjI0Z1lYTWdjbVZoYzI5dVlXSnNlU0J3Y21GamRHbGpZV0pzWlNCaGJtUWdhVzRnWVc1NUlHVjJaVzUwTENCM2FYUm9hVzRnYjI1bElHMXZiblJvSUc5bUlIbHZkWElnY21WeGRXVnpkQzRnVUd4bFlYTmxJRzV2ZEdVZ2RHaGhkQ0IzWlNCdFlYa2dibVZsWkNCMGJ5QnlaWFJoYVc0Z1kyVnlkR0ZwYmlCcGJtWnZjbTFoZEdsdmJpQm1iM0lnY21WamIzSmthMlZsY0dsdVp5QndkWEp3YjNObGN5QmhibVF2YjNJZ2RHOGdZMjl0Y0d4bGRHVWdZVzU1SUhSeVlXNXpZV04wYVc5dWN5QjBhR0YwSUhsdmRTQmlaV2RoYmlCd2NtbHZjaUIwYnlCeVpYRjFaWE4wYVc1bklITjFZMmdnWTJoaGJtZGxJRzl5SUdSbGJHVjBhVzl1TGp4aWNpQXZQZ284WW5JZ0x6NEtQSE4wY205dVp6NHhNeTRnUTA5TlVFeEJTVTVVVXp3dmMzUnliMjVuUGp4aWNpQXZQZ284WW5JZ0x6NEtWMlVnWVhKbElHTnZiVzFwZEhSbFpDQjBieUJ5WlhOdmJIWmxJR0Z1ZVNCamIyMXdiR0ZwYm5SeklHRmliM1YwSUc5MWNpQmpiMnhzWldOMGFXOXVJRzl5SUhWelpTQnZaaUI1YjNWeUlIQmxjbk52Ym1Gc0lHUmhkR0V1SUVsbUlIbHZkU0IzYjNWc1pDQnNhV3RsSUhSdklHMWhhMlVnWVNCamIyMXdiR0ZwYm5RZ2NtVm5ZWEprYVc1bklIUm9hWE1nVUc5c2FXTjVJRzl5SUc5MWNpQndjbUZqZEdsalpYTWdhVzRnY21Wc1lYUnBiMjRnZEc4Z2VXOTFjaUJ3WlhKemIyNWhiQ0JrWVhSaExDQndiR1ZoYzJVZ1kyOXVkR0ZqZENCMWN5QmhkRG9nWVdSdGFXNUFkWE4wWVhoeVpXeHBaV1poWjJWdVkza3VZMjl0SUZkbElIZHBiR3dnY21Wd2JIa2dkRzhnZVc5MWNpQmpiMjF3YkdGcGJuUWdZWE1nYzI5dmJpQmhjeUIzWlNCallXNGdZVzVrSUdsdUlHRnVlU0JsZG1WdWRDd2dkMmwwYUdsdUlETXdJR1JoZVhNdUlGZGxJR2h2Y0dVZ2RHOGdjbVZ6YjJ4MlpTQmhibmtnWTI5dGNHeGhhVzUwSUdKeWIzVm5hSFFnZEc4Z2IzVnlJR0YwZEdWdWRHbHZiaXdnYUc5M1pYWmxjaUJwWmlCNWIzVWdabVZsYkNCMGFHRjBJSGx2ZFhJZ1kyOXRjR3hoYVc1MElHaGhjeUJ1YjNRZ1ltVmxiaUJoWkdWeGRXRjBaV3g1SUhKbGMyOXNkbVZrTENCNWIzVWdjbVZ6WlhKMlpTQjBhR1VnY21sbmFIUWdkRzhnWTI5dWRHRmpkQ0I1YjNWeUlHeHZZMkZzSUdSaGRHRWdjSEp2ZEdWamRHbHZiaUJ6ZFhCbGNuWnBjMjl5ZVNCaGRYUm9iM0pwZEhrOFluSWdMejRLUEdKeUlDOCtDanh6ZEhKdmJtYytNVFF1SUVOUFRsUkJRMVFnU1U1R1QxSk5RVlJKVDA0OEwzTjBjbTl1Wno0OFluSWdMejRLUEdKeUlDOCtDbGRsSUhkbGJHTnZiV1VnZVc5MWNpQmpiMjF0Wlc1MGN5QnZjaUJ4ZFdWemRHbHZibk1nWVdKdmRYUWdkR2hwY3lCUWIyeHBZM2t1SUZsdmRTQnRZWGtnWTI5dWRHRmpkQ0IxY3lCcGJpQjNjbWwwYVc1bklHRjBJRHhoSUdoeVpXWTlJbTFoYVd4MGJ6cGhaRzFwYmtCMWMzUmhlSEpsYkdsbFptRm5aVzVqZVM1amIyMGlQanh6ZEhKdmJtYytZV1J0YVc1QWRYTjBZWGh5Wld4cFpXWmhaMlZ1WTNrdVkyOXRQQzl6ZEhKdmJtYytQQzloUGlCdmNpQXpPRE13SUZjdUlEY3pjbVFnUVhabExDQlRkV2wwWlNBeU1ESXNJRmRsYzNSdGFXNXpkR1Z5TENCRFR5QTRNREF6TUM0PSJ9